|

Asia Daily PP PE Report 24 Dec 2015Asia Daily PP PE Report 24 Dec 2015 |

|

CommoPlast

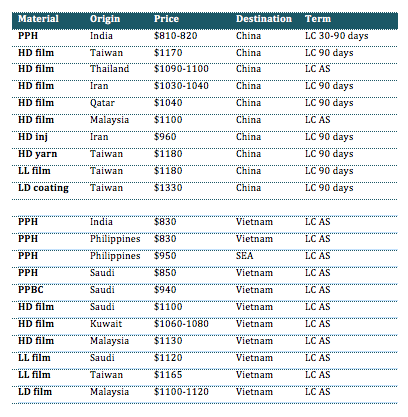

In China, May futures on Dalian Commodity Exchange completed today trading session at CNY149/t ($23/t) higher for PP and CNY60/t ($9/t) higher for LLDPE. Contract 1605 concluded at CNY5888/t ($777/t without VAT) for PP futures while it is CNY7865/t ($1037/t) for LLDPE. The most notable even on futures trading today is that the volume for PP futures has skyrocketed by 68% to reach 2,597,512 contracts from 1,543,840 in the previous trading day.

Physical spot offers for both PP and PE in domestic market see a CNY50-100/t ($8-15/t) firmer compared to yesterday while there is little movement in import market reported. A trader in Ningbo commented, “Thanks to firmer energy and futures values, local buyers are more confident in making pre-Chinese New Year purchases now. We manage to conclude a good number of deal today and we think that this this will sustain in the near term.”

Most part of Southeast Asia market is off today with sentiment has not shown much improvement. The PP market remained mostly stable despite firmer propylene cost due to lacklustre demand. However, more trading activities are reported in the Vietnam today with a distributor said, “We managed to sold out Indian homo-PP at $830/t CIF Vietnam after giving $10/t discount from the initial offer. Local traders are very reluctant to make fresh purchases; hence we sold mostly to converters.” Another woven bag maker received Philippines homo-PP offer at $830/t CIF Vietnam yesterday, but the supplier reportedly sold out shortly after open the offer. The source commented, “We still have sufficient stock till end of Jan 2016 but we are planning to make some purchases for Feb 2016. We might hold our decision till after the holidays to have a clearer market outlook.”

In the PE market, negotiation is still on going for import cargoes but demand for LLDPE film is reported to be better in local Vietnam market due to delay of some Middle East cargoes. Meanwhile, locally held HDPE film cargoes are being traded below LLDPE film as supply for this grade is more sufficient. A trader reported, “Our Middle East supplier is offering prompt HDPE film cargoes at $1100/t CIF Vietnam, but it has to be bundled with some off-grade cargoes. We are still considering about this offer because local HDPE market is not that strong.” Another buyer placed bid for prompt Middle East LLDPE film cargoes at $1060/t CIF said, “Our supplier will revert to us after the Christmas holiday, but in general we cannot accept price above this level as we are bearing big loses from previous cargoes.”

*Please note that CommoPlast will not have Daily report on 25 Dec, 31 Dec and 1 Jan. Thank you for your support.

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.