|

Asia Weekly PVC Overview (Week 33, 08-12 August 2016)Asia Weekly PVC Overview (Week 33, 08-12 August 2016) |

|

In Asia, there are very limited trading activities this week as most players are waiting for the Taiwanese major to announce September delivery prices. Despite calmer sentiment across the region as demand is dampened by the monsoon season, many players have expressed their expectation for $20-30/ton hike on September prices given limited availability from Fareast Asian producers.

Indeed, the firming trend has been gaining support mainly from the supply side recently, not only scheduled shutdown in the Fareast region but also unexpected outages in the USA. An international trader added, “This might keep the influx of USA cargoes on check as suppliers there might need to fulfill domestic needs first. We therefore feeling very optimistic about the near term outlook.”

In India, demand remains weak as most converters in the pipe and profiles sector are complaining about slow end product demand. For that, a major domestic producer decided to rollovers their local offers for this week in spite of tight allocation from international suppliers. A trader said, “We think the Taiwanese producer might continue to increase their offers for September delivery, though the range would be moderate. Prices above $900/ton threshold at the moment attract very little buying interest.” The source added that with the monsoon expected to end in September, demand outlook is positive.

In China, local prices continue to firm up, accumulating some CNY200-300/ton ($30-45/ton) hike from last week, yet demand is reported to be satisfactory. Indeed, August-September is regarded as traditional high demand season in the country, while many buyers in Eastern China area are rushing purchases before the road ban ahead of G20 Summit in early September 2016. An ethylene-based PVC maker from Ningbo reported, “We managed to sell out a good quantity of material even after the price hike. We might need to adjust production rate in compliance with government guidelines during the G20. We think the Chinese sellers might concentrate on local ground this month instead of pushing for export, that might also support firmer international trend.”

Demand in Southeast Asia is deemed to be weakest in the region though there are market talks about some technical glitches at one of Thailand producers’ plants. A Malaysian pipe maker informed, “We have received confirmation from a Thai supplier that allocation for the coming month would be affected. We are not in rush to commit fresh purchases as we are covered till October. Demand for our end product is suffering from weak economic performance and tighten bank credit, and at the moment we have yet to see any sign of a possible pick up in the near term.”

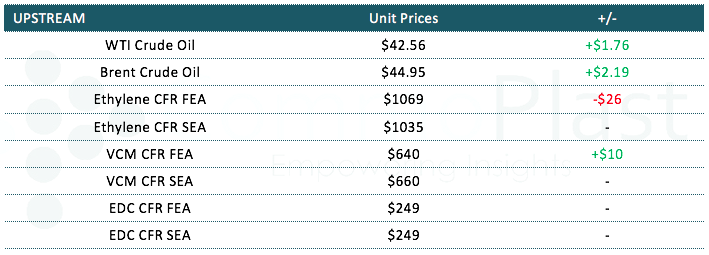

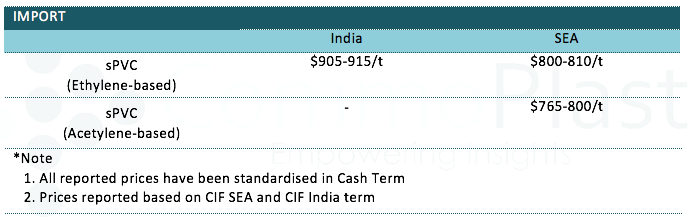

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.