|

Asia Weekly PVC Overview (Week 36, 29 August - 02 September 2016)Asia Weekly PVC Overview (Week 36, 29 August - 02 September 2016) |

|

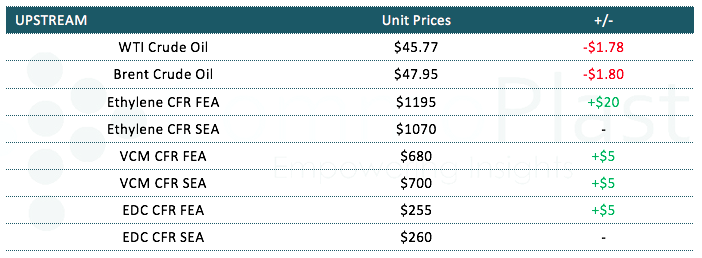

In Asia, there is little movement in the PVC market this week as most deals are concluded while buyers stayed on the sideline monitoring further movement to gauge likely market direction in the coming weeks. However, most have expectation for further hike considering factors such as firm upstream costs and tight availability. The news on Korea’s largest shipping operator – Hanjin Shipping Co filed for bankruptcy protection sent shivers down the market as several Korean PVC cargoes en-route India are expected to be delayed.

There are reports on an increasing number of purchase enquiries from Korean traders, who are looking for substitute prompt cargoes for those that might have been temporarily locked up with Hanjin Shipping Co, to fulfill their purchased orders in Indian subcontinent area. An Indian trader informed, “The delay in these shipment might encourage other major producers to implement larger hike this month, despite the possibility that demand in India this month might slow down due to the festive season ahead.” The source anticipated an increase of $30-40/ton for October delivery offers. Another trader in the country added, “Another source of supply – Iran, might be unable to allocate sufficient quantity to India market this month as we hear domestic demand here is really good at the moment.”

In China, domestic offers remain unchanged from last week, yet demand is reportedly weaker due to the absence of buyers in Eastern China market ahead of the G20 Summit. Yet, sellers are in no rush to offer discounts claiming lack of sales pressure and positive outlook in September. A carbide based PVC producer commented, “Our production costs are still high and we think market might remain on the firm track in the near term given tight supply and positive demand outlook in India. Local demand is a bit sluggish this week, yet we managed to deplete a good quantity previously, hence we are free from sales pressure for now.” Export offers from the country are also stable.

Southeast Asian market remain calm despite supply has yet to see any improvement, especially from Thailand suppliers. VinylThai reportedly restarted its VCM line last week after encountered some unexpected issues at its plant earlier. However, PVC allocation to export market from the company is still tight. Another producer in Thailand informed, “We are not having comfortable supply as well. Local demand is pretty healthy recently; hence our export allocation has been shrunk. Our Malaysian customers are very reluctant to replenish cargoes, yet we are confident that market might continue to move north in the near term.”

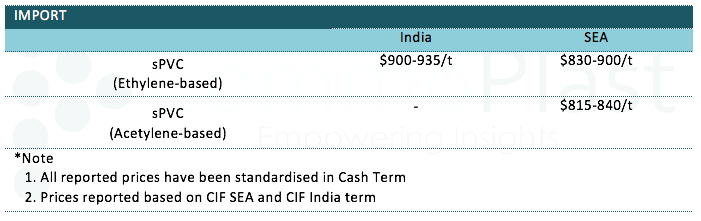

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.