|

Asia Weekly PVC Overview (Week 37, 05-09 September 2016)Asia Weekly PVC Overview (Week 37, 05-09 September 2016) |

|

In Asia, the PVC market remained mostly unchanged from the previous week as players completed September businesses and currently waiting for October shipment offers. Limited supply stemming from plant shutdown is expected to push prices up. Initial expectation called for $20-30/ton hike; however, delayed cargoes after Korea’s Hanjin Shipping declaring bankruptcy might encourage large increment.

An international trader reported to have 90 of forty footer containers being impounded in Singapore main port due to the Hanjin bankruptcy case. The source said, “Most of the containers are PVC that were scheduled for our customers in Bangladesh. We are not sure how long it would take for us to clear these parcels, and at the moment we only can wait. Our customers might need to purchase material from other sources to meet immediate need.”

An Indian buyer added, “Domestic demand is still stable and might improve in the near term. We initially expect some $20-30/ton hike for October delivery shipment given shutdown at major supplier’s plants. However, several cargoes got delayed due to the Hanjin Shipping Co. issues, which might encourage sellers to implement larger hike than expected.” India market is embracing the Diwali festival by end of October, from which players are expected to replenish some cargoes before depart for the holidays.

Meanwhile, domestic spot market in China continue to firm up with offers for both ethylene and carbide based PVC added CNY100/ton ($15/ton) from last week. Players attributed higher transportation costs to be the main culprit behind such hike. A carbide-based PVC maker from Inner Mongolia said, “We paid extra CNY80/ton ($12/ton) for transportation cost this week. Our domestic customers have accepted the hike amount and continue to place orders given tight availability. We expect local prices to add another $30/ton in the near term following the international trend.” The maker also implement $10/ton increased on export cargoes, yet feedback from Southeast Asian market is rather disappointed.

Most buyers in Malaysia and Indonesia claimed to have sufficient material and might only replenish minimum quantity, as end product businesses are slow. A trader in Indonesia informed, “The construction sector here is very weak. One of our major pipe-manufacturing customers is currently operating only 8 machines out of 87 they have. We are uncertain on the market outlook in the near term, hence we might expand our focus to other sector.”

Market sources also expected international freight rates to increase after Hanjin bankruptcy case, especially the USA-Asia route, as Hanjin was active in this line. In fact, the WSJ is quoting an increase of 40-50% in shipping rates on Asia-US cargo since early this week. This might affect market prices in the near term.

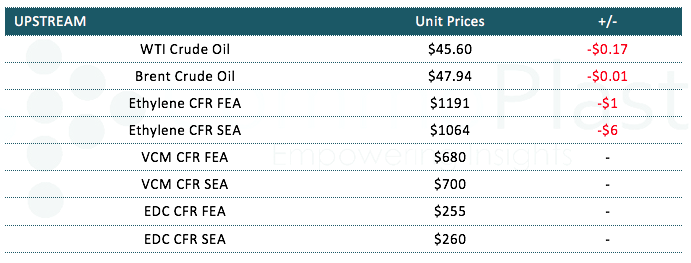

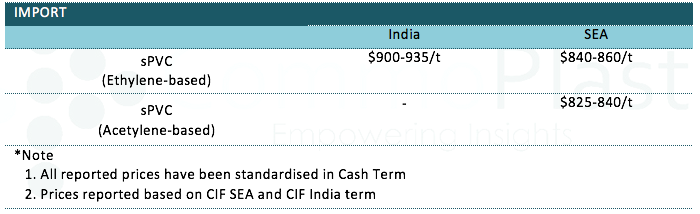

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.