|

Asia propylene costs surged on tight supplyAsia propylene costs surged on tight supply |

|

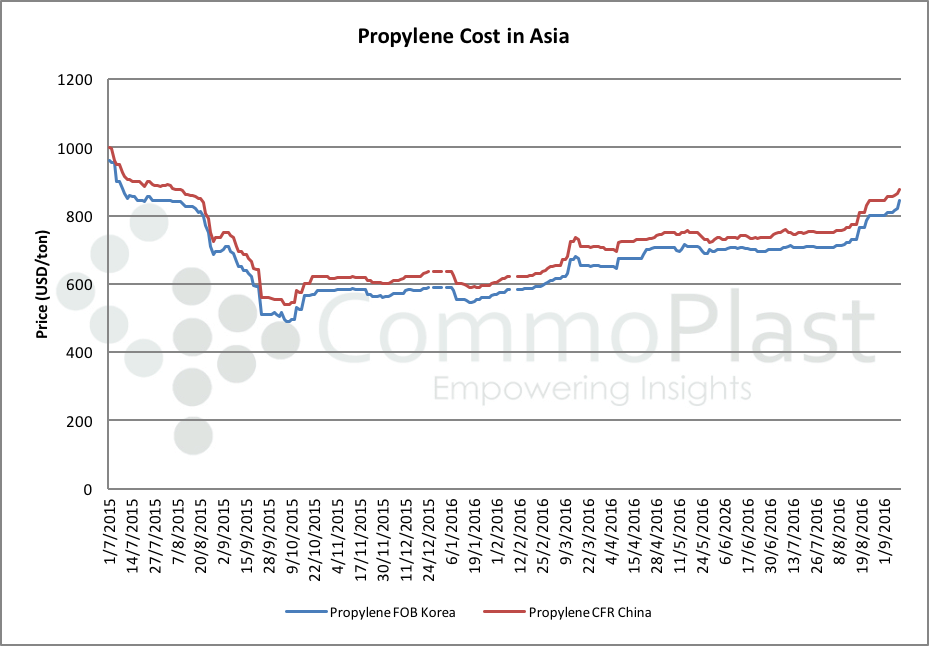

In Asia, a series of major plants shutdown has pushed propylene costs in the region to the 14-months high recently. Indeed, propylene cargoes based on FOB Korea term surged $25/ton in a single day last Friday, accumulating a week over week gain of $35/ton as shown in the following graph.

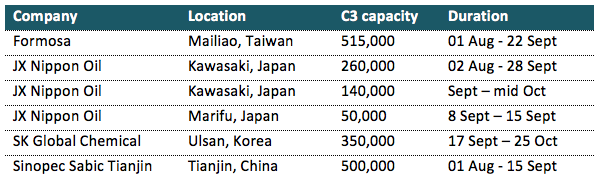

Japan’s JX Nippon unexpectedly shut its residue fluid catalytic cracker at Marifu last Thursday due to technical issues, according to market sources. The 50,000 tons/year cracker is expected to remain offline for approximate one week. Meanwhile, Korea’s SK Global is scheduling an annual maintenance shutdown at its No. 2 naphtha cracker late this week. Few other plants might resume production within this month, yet healthy demand from China’s downstream market is encouraging suppliers to lift their prices.

Increases in propylene prices were thought to have positive impact on the PP market; however, buyers are expressing otherwise opinion. An international trader commented, “Our Middle Eastern principal suppliers are on holidays, hence we might not announce any new offer this week. Most of our regular customers have already replenished sufficient material in the past weeks; hence we see very little buying interest. This might prevent any significant price increment despite stronger upstream costs.”

Chinese players are embracing the mid-Autumn festival holidays starting this Thursday, which has also dampened buying interest in the country. Firming propylene costs somehow have been overshadowed by the holiday mood and falling futures trade in the country. A PP converter reported, “We have replenished sufficient material for the coming week, therefore we need not to make additional purchases in the coming days. We prefer to monitor further market development after the holiday before deciding on fresh cargoes in-take.”

Import homo-PP to China at the moment is reported at $970-980/ton CFR China, LC 0-90 days term, which is below the theoretical costs at the current propylene prices. However, domestic makers are still benefiting some minor margins due to stronger buying interest for local material.

The question is how long would this trend sustain as several plants are set to resume operation within September, which might ease regional supply by the following month. PP buyers therefore are taking very cautious stance toward fresh purchases.