|

Asia Weekly PVC Overview (Week 44, 24-28 October 2016)Asia Weekly PVC Overview (Week 44, 24-28 October 2016) |

|

In Asia, major Taiwanese producer reportedly sold out allocation for November delivery after implemented some $40/ton hike in the previous week. Demand in India; however show some signs of slowing down ahead of the long Diwali holidays, which forces international suppliers to divert their cargoes to other regional markets.

An international trader said, “Our principal Taiwanese supplier seems to have overcome previous production issues and restored regular export quantity. Indian customers are putting on holiday mood, hence not very aggressive in taking cargoes. In fact, we have to divert 5,000 tons out of 25,000 tons of allocation for this market to China due to weaker than expected buying interest.” However, the upcoming ethylene pipeline migration at Taiwan’s CPC might affect some VCM production in the country, though involved parties are working on alternative delivery methods to minimize the probability of a production disruption.

However, post holiday market outlook remain very optimistic in India with a trader commented, “Trading activities are limited this week and might sustain throughout the coming week as players would only resume operation on 5-6 November. We expect peak seasonal demand to kick-off right after the holidays end, hence market might remain on the firming trend in the coming month.”

Meanwhile in China, resilient demand amid limited supply continues to push domestic prices up CNY50-100/ton ($8-15/ton) from last week. Most local producers here are reporting lacking of sales pressure and higher production costs would keep the current trend in place. A carbide based PVC producer in inner Mongolia, whose export offers stand at $940/ton FOB China, LC AS term said, “Respond from international buyers is not as positive as expected, however, we still achieve satisfactory sales in local ground. The recent hike in carbide, electricity and transportation costs have cut into our margins, hence we need to hold firm stance on our prices.”

Southeast Asian buyers are also expressing expectation for firmer prices in the coming months considering healthy demand in Indian and China, from which many buyers are replenishing to maintain stock levels. A converter in Malaysia received Chinese ethylene based PVC at $910/ton CIF, LC AS term reported, “We also received offers for carbide based PVC at only $5/ton lower and we have replenished sufficient material to cover our need till December. There are many supportive factors for another hike next month, though demand for our end product is just regular.”

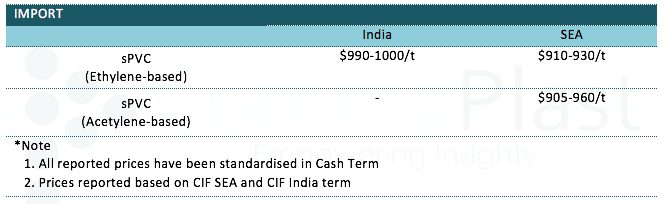

A summary of import PVC prices to the region is shown in the following table: