|

Falling propylene costs vs. tightening supply: Uncertainties facing Asia PP marketFalling propylene costs vs. tightening supply: Uncertainties facing Asia PP market |

|

In Asia, propylene costs based on FOB Korea term has fallen $95/ton since it hit 15-months high during mid-October 2016. Improved supply condition within the region is blamed for such drop and industry experts are raising concern about further reduction in the near term.

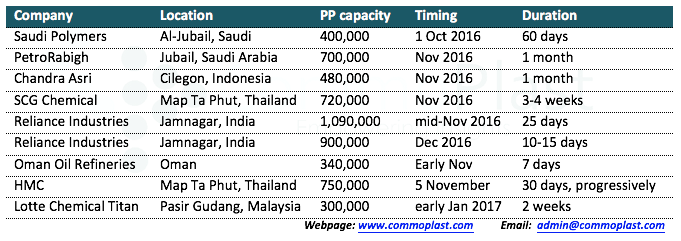

In addition to softening energy values, the implication on downstream PP market appears to be pretty clear. However, players are now bemused with the possible market direction in the coming weeks given a series of unexpected maintenance shutdown at major international plants. Detailed information on these overhauls are shown in the following table:

Supply is expected to be tightening during November and early December and a question players are asking is whether this is sufficient to keep the current firming trend on going?

An international producer informed, “Most suppliers are not having inventories pressure at the moment after achieving satisfactory sales result in China recently. We believed that market would sustain the stable to firmer trend in the coming month as preparation for Lunar New Year shall take place soon which boost demand amid tightening supply.”

Players however argued that this might be more applicable to China market, where healthy demand is casting spillover effect to nearby Southeast Asia region. Looking at Vietnam specifically, domestic traders are cutting prices on growing supply levels resulted from the arrival of previously purchased cargoes. A source said, “At the moment, prices above the $1030/ton mark attract very limited buying interest, especially among traders. We have comfortable stock on hand, hence skip replenishing this round. Prices might face really difficult time to increase further.”

Another regional buyer added, “We think the PP market would remain on the firm track for the remaining of the year due to a number of plant shutdown. However, the extent of price increment might be limited if propylene costs continue to fall.”

While players are expressing diverged opinion about the impact of the above mentioned factors on the near to medium term outlook, it might be a better option to monitor the demand condition, especially pre-Chinese New Year replenishment activities in China. A Chinese trader said, “We used to have pre-Christmas replenishment, but now it is very subdue in line with weak Western economy. At the moment, we are still not very sure about Chinese New Year order for end products. Consumers might decide to purchase needed goods during this 11 November sales event instead of waiting till last minutes. One thing to be sure is that manufacturers would still need to restock due to low inventories on hand.”