|

Asia Weekly PVC Overview (Week 45, 31 Oct - 04 Nov 2016)Asia Weekly PVC Overview (Week 45, 31 Oct - 04 Nov 2016) |

|

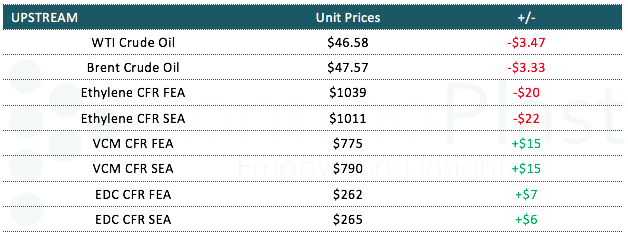

In Asia, PVC market remains mostly stable this week with Indian players are away for Diwali celebration and would only come back by next week. Most deals for November shipment have been concluded and market participants are waiting for Taiwanese major to announce December offers. The general expectation is that price might continue to advance given supports from both upstream and downstream markets.

An international trader informed, “We have sold out November allocation for now. We think supply from Fareast Asian producers might remain tight in the near term, especially from Chinese producers, as healthy domestic demand distracts export activities. In addition to firming VCM costs, we think market is set for another hike.”

It is still unclear on whether ethylene pipeline migration work of Taiwan’s CPC would affect Formosa’s VCM production; however, in November, it is reported that the producer has exported an approximate 58,000 tons of PVC, which is very close to regular allocation, suggesting the company might be operating its plant at normal rate.

Meanwhile in China, domestic market witnessed another CNY100-200/ton ($15-30/ton) hike for both ethylene and carbide based cargoes compared to previous week and sentiment is boosted further with the support of strong futures market. A carbide-based PVC producer informed, “Supply for carbide feed is still very limited hence our profit margins is squeezed by higher costs. Besides, transportation issues from Northern to Southern China have yet to be resolved, causing a series of delay in delivery. We are happy with the current state of demand in local market and expecting this condition to persist in the near term.” The source also added that they have lifted export offers to $990-1000/ton CIF Southeast Asia, LC AS term, yet respond from buyers is very disappointed.

Southeast Asian buyers appear to have replenished much needed cargoes and prices near to the $1000/ton threshold are attracting no buying interest at the moment. In spite of such reluctance, players here are not seeing possibility of a price reduction with a market source commented, “Looking at the current upstream costs and the bright prospect of post-holiday demand in India market, we think international suppliers might attempt another hike, at least on the same pace with the increases in VCM costs. We have secured sufficient stock, therefore not in rush for additional purchases.”

Meanwhile, Indonesian buyers are complaining about persistent weak end product demand condition and many have expressed their unwillingness to accept another significant price increment.

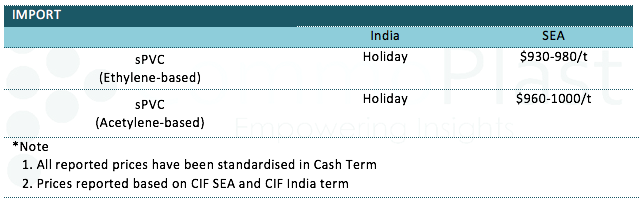

A summary of import PVC prices to the region is shown in the following table: