|

Asia Weekly PVC Overview (Week 49, 28 Nov-02 December 2016)Asia Weekly PVC Overview (Week 49, 28 Nov-02 December 2016) |

|

In Asia, market remained mostly unchanged a week after international suppliers announced December delivery offers to the region. Demand in India continues to wan amid monetary issues while Southeast Asia are resisting high prices. Market was putting hope on healthy demand in China to support continuous firming trend, however, sellers might soon find disappointment as domestic market started turning south.

In fact, domestic carbide based PVC in China faces downtrend for two weeks in a row now, falling approximate CNY375/ton ($54/ton) since its peak during mid of November 2016 on easing supply and weakening futures market. Buyers in the country considered this as a correction to bring back the usual price gap between carbide and ethylene based PVC. On the other hand, ethylene based PVC makers are holding very firm on their cargoes, resulted in a premium of CNY550/ton ($80/ton) over the carbide based. For this, it is likely that ethylene based PVC shall soften in the near term to retain the competitiveness, market sources said. An ethylene-based producer added, “We are still holding wait and see stance to monitor further development before taking any concrete action. Demand is slower now and there is a possibility that more international suppliers would divert their cargoes to China as a result of the recent cash crunch in India that dampens demand.”

Discussion on whether Chinese converters would stock up material before the long Lunar New Year holidays is on going. Many have pointed to the weakness in the construction sector during the winter for bearish demand prospect while others argued that the same weather condition could also prevent smooth transportation, causing persistent supply tightness in southern and eastern China. And therefore, buyers shall need to pre-book the material to avoid production disruption, sources said.

Meanwhile, India market is still struggling with the recent monetary issues and experts are projecting that the country might need up to six months to normalise the situation. Players in the country reported weak demand and high supply, which to many traders, would prevent any further attempt to increase prices from international suppliers. A pipe converter said, “The high demand season this year is really disappointed. Our customers are cancelling some of previously placed orders and we have no choice but to moving our raw material to the spot market to reduce inventory pressure.”

Another trader added, “The whole market is stalled. We received no new inquiries and with China market started seeing downward adjustment, we expect no further price increment for January delivery.”

The Southeast Asian market remains on the trail with little improvement in term of demand reported. Many sellers are taking cautious stance over the near term outlook as buyers are showing little interest in stocking up material. A Vietnamese trader said, “We still received satisfactory number of enquiries from local market thanks to limited availability from one of the major domestic producers. Meanwhile, we plan not to make large replenishment from the import market given the risk of down trend in China and slow buying interest in India.”

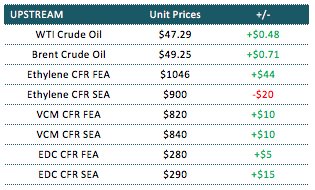

Despite softer demand condition across the Asia region, higher upstream costs might keep any possible significant price reduction at bay in the coming days. In another news, Indonesia’s Asahimas is due to take its 400,000 tons/year No 3 VCM plant in Anyer offstream in the coming week for two weeks maintenance. This is expected to keep the regional VCM supply tight throughout this month.

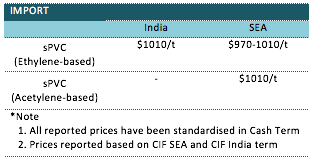

A summary of import PVC prices to the region is shown in the following table: