|

Asia Daily PP PE Report 05 Jan 2016Asia Daily PP PE Report 05 Jan 2016 |

|

CommoPlast

In China, futures prices on Dalian Commodity Exchange contract number 1605 settled at CNY14/t higher for PP to reach CNY5803/t ($760/t without VAT) while LLDPE futures gain CNY25/t to close at CNY8050/t ($1055/t without VAT).

The tumbling stock market did not generate any immediate effect on the physical spot market; in fact, local offers for both PP and PE are CNY100-200/t ($15-30/t) higher compared to last week with trading activities appear to be steady. A trader in Yuyao reported, “We managed to conclude a good number of deal for coal based homo-PP today due to tight supply for this material in domestic market. Our regular customers are taking up cargoes in anticipation of further price increase in the near term.”

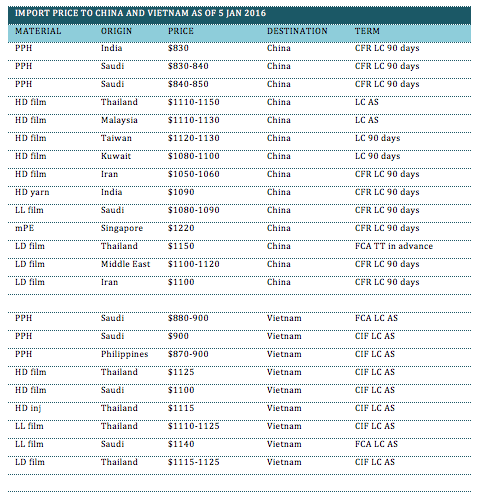

In the import market, players are blaming the weakening Chinese Yuan for the mediocre demand in the past couple of days, especially for homo-PP. However, buyers are reportedly taking up prompt LLDPE film and LDPE film parcels due to limited supply for these grades, according to market sources. A Shanghai trader sold Thai LDPE film cargoes at $1150/t FCA China, TT in advance said, “Our Thai supplier did not offer LLDPE film and LDPE film to China these two weeks due to the impending shutdown during Feb-March 2016 period. Supply for these grades in the market is a bit tight and we are selling previous cargoes now. We expect this condition to improve in the near term as there are number of cargoes are arriving soon.” Many are expressing pessimistic view regarding the market outlook this week, yet they are also awaiting another round of pre-Chinese New Year replenishment from buyers in the coming week.

In Vietnam, post holiday market sentiment remains on stable to firm trend, however, purchasing activities are reported to be slow. In the PE market, a major Thailand producer announces new price with $10/t higher compared to last week at $1125/t for HDPE film, LLDPE film and LDPE film, CIF Vietnam, LC AS term. A buyer receive the new offer commented, “We are considering to make a small purchase but we are talking to our supplier to obtain some discount.” Meanwhile, another producer in Southeast Asia said, “We receive more enquiries from Vietnamese customers these two days but we have sold out our allocation for Jan. At the moment, we have yet to announce Feb shipment price but we expect some small increase since our quantity is not sufficient.”

Apart from the unexpected shutdown at Shell Singapore plant, there are also number of crackers in Asia will be under maintenance shutdown during the first quarter of 2016, which support the monomers market in the past one-month. In fact, tight supply has lifted ethylene (C2) CFR Southeast Asia and propylene (C3) FOB Korea by approximate $30/t compared to beginning last month to reach $1085/t and $590/t respectively. Some players are expecting to see spill-over effect on the polyolefins market in the coming days.

In the PP market, most of the suppliers have yet to open new offers while others are maintaining their prices stable to firmer compared to previous week. Philippines homo-PP is reported to be $30/t increased from last week to reach $900/t CIF Vietnam, however, the supplier has closed the offer on the same day. A trader said, “Trading activities in local market has shown some improvement, but we still refrain from making fresh purchases at the new price level. We would like to wait for more offers from Middle East suppliers before making decision. We think that PP market might sustain the stable trend in the near term.”

Firming sentiment is also observed in India market with a trader reported, “Our Middle East homo-PP supplier is aiming to increase their price to $880/t CIF India, LC AS term while other sellers are very reluctant to give any discount.” However, buyers are not rushing to make purchases due to weak end product demand, according to market sources.

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.