|

Asia Weekly PET Overview (Week 01, 03-06 January 2017)Asia Weekly PET Overview (Week 01, 03-06 January 2017) |

|

In Asia, the PET market remains on the stable to firm track thank to strong support from firm MEG costs. However, demand across the region has not shown any sign of improvement, instead most bottle makers are slowing down on fresh replenishment ahead of the traditional slow season.

Despite weaker than expected buying interest, producers, especially from China are not in the position to adjust their offers to smoothen sales process given difficulties they faced in locking feedstock costs. A Chinese PPET producer commented, “Purchasing activities in local market might continue to weaken in the coming weeks as the Lunar New Year draws near. Just yet, MEG availability is rather limited.”

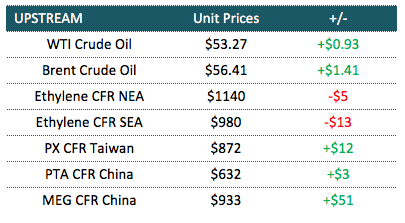

In fact, the recent government effort to curb air pollution across 70 cities in the country has forced thousands of plants to shutdown or reduce operation rate, including several small to medium size coal based MEG units. Transportation is also restraint, hurdling the flow of material within. Together with couple of major plant issues in Middle East, MEG costs is expected to hold firm throughout January. PET producer therefore might have very limited room for large downward price adjustment, players said.

Meanwhile, Southeast Asian players are also reporting mediocre end product demand, which discourages raw material purchasing activities. A Vietnamese PET bottle manufacturer commented, “We are rushing for the final batch of Lunar New Year end product orders, however we have purchased sufficient material in the previous month. We plan to source only small quantity this month as February is normally a slow month for us.”

Demand condition in Indonesia remain under pressure as the lack of end product businesses has forced a number of small converters to shutdown their plant to mitigate loses. This explains to why domestic market has not been able to catch up the increase in upstream costs recently. A major local producer rollover their offers to domestic buyer said, “Couple of our regular customers have stopped operation and therefore, we are allocating the excess quantity to larger buyers. Fortunately, we are not having inventories pressure and for this we plan to maintain our offers unchanged.” It also appears that local buyers here are unable to accept any further price increment with a market source added, “Our profit margin is being squeezed by high production costs and slow end product business. Only mineral water bottles received better orders. We prefer to only source on need basis until end product order improve.”

Moving forward, three new PET plants in China are scheduled to come online within quarter 1 this year, adding another 1.65 million tons/year to the market. Prices might face downward pressure if demand does not pick up to accordingly.

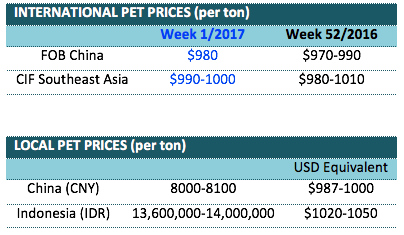

The following tables show prices in the region this week: