|

Asia Weekly PET Overview (Week 02, 09-13 January 2017)Asia Weekly PET Overview (Week 02, 09-13 January 2017) |

|

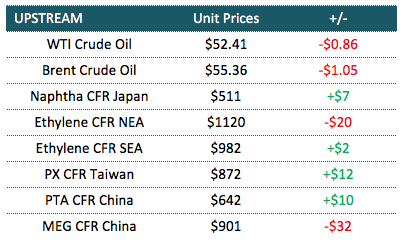

In Asia, the PET market remains on the stable to firmer trend though trading activities across the region see little improvement as many players are slowing down their replenishment activities ahead of the long Lunar new Year holidays. However, suppliers are rather positive about the price direction in the post holiday period, considering strong support from the upstream costs.

In fact, market sources reported at least eight aromatic plants, which mainly produce PX and benzene are scheduled for maintenance shutdown during the second quarter this year. In addition to a multiple refineries issues in the international market that boosts naphtha prices recently, players are seeing a strong cost-push support for PET prices.

In China, sentiment in the PET bottle sector is weakening as converters have fulfill the last end product orders and preparing to go off for holiday. A beverage bottle manufacturer commented, “We might shutdown out plant earlier than usual due to lack of end product orders. We have replenished sufficient material in the previous week, hence not planning we make additional purchases in the coming days.”

In contrast, it is reported that demand from the polyester sector remains resilient and many manufacturer have requested for additional PTA quantity in the local market. This, again, plays an important role in keep PTA outlook on a bullish trend.

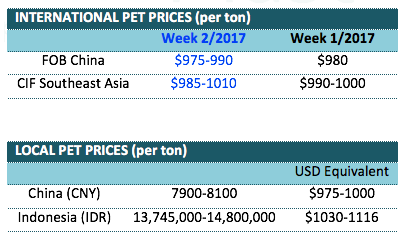

Meanwhile, Southeast Asian players remain hesitant to make large purchases despite couple of Fareast Asia makers are attempting to increase their prices. A Vietnamese buyer received Korean PET at $1000/ton CIF, LC AS term commented, “We have sufficient material until end of March and we are not planning for fresh purchases yet. Our end product is regular and we hope to see improvement after the Lunar New Year, in line with the approaching summer season. We are monitoring further development and might buy addition quantity after the holidays.”

Similar situation is observed in local Indonesia market where higher production costs encouraged producer to increase their offers regardless of stiff buyer’s resistance. A producer implemented $22/ton hike on their cargoes to local buyers this week commented, “MEG costs have been hovering above the $900/ton threshold for sometime, therefore we have no other option but to increase our offers to protect our margins. Besides, we are not having high stock at the moment. It appears that buyers are also running low on inventories, as most have not procured any import cargoes in the past months.” For this, several converters reportedly purchased cargoes at the new price levels though this might hurt their profits.

The following tables show prices in the region this week: