|

Asia Weekly PVC Overview (Week 07, dated 13-17 February 2017)Asia Weekly PVC Overview (Week 07, dated 13-17 February 2017) |

|

In Asia, a major Taiwanese producer has announced March delivery offers to regional market with $40/ton hike to Indian and $30/ton to other markets. It is reported that buying interest in India is coming back healthy, which is expected to drive market higher in the coming months, in addition to the strong upstream costs.

Indian buyers are very fast reacted to the new prices, accepted to purchase the cargoes without any major discount. The suppliers therefore, reportedly sold out all 20,000 tons allocation to India just few hours after new price announcement. A trader commented, “Demand is warming up and we think other international suppliers would announce new offers with similar increases. We are feeling optimistic about the near term outlook.” In fact, market sources also reported sold out quantity from a Japanese maker at similar price level as Taiwan’s producer.

Supply in India might tighten further as the recent labor strike has affected production at one of the major domestic producer. It is unsure on how severe is the impact on the producer’s operation rate, however, the labor strike has been on going since 3 February 2017. A trader in the country informed, “The labor strike has affected the supply, yet demand hold steady. Availability will be tightened and price might firm up again in the coming days. We hope the producer would resume normal production rate soon.”

Meanwhile, in China, two separate incidents took place at Xinjiang Yihua and Qinghai Salt Lake Haina Chemical Co Ltd, causing emergency shutdown at two carbide feedstock plants, which combined capacity go up to 1.85 million/ton. This is expected to worsen the supply tightness condition for carbide in the country and might stem stricter environmental control action from the government, players said.

Local offers for both carbide based and ethylene based PVC firmed up CNY100-200/ton ($15-29/ton) week on week basis. A carbide based PVC producer added, “Domestic market remain sluggish, yet prices are expected to sustain the current trend throughout this quarter considering the current costs and international market development. We managed to conclude several deals to Southeast Asia buyers at $880/ton FOB China, LC AS term, which is $20/ton increased.”

Within Southeast Asia region, the latest price increment is very much anticipated among Malaysian buyers, which explained to why a good number of pipe and profile manufacturers have already stocked up sufficient quantity. On the other hand, Indonesian buyers reported receiving fresh local offers with $40/ton increased from last month, in line with the firming trend observed in the international ground. Compared to January, average local PVC offers has firmed up $40/ton, reaching $1000-1040/ton, FD Indonesia, cash term. Yet, there is no sign of a significant improvement in term of demand in the country.

Couple of regional producers is planning to lift their offers, in line with the trend pioneered by Taiwanese major. A maker commented, “We might implement $30/ton hike on March delivery cargoes. Demand in Indonesia and Thailand is still weak while supply is tight in Vietnam. Besides, we think India market would offer better export opportunity in the near to medium term.”

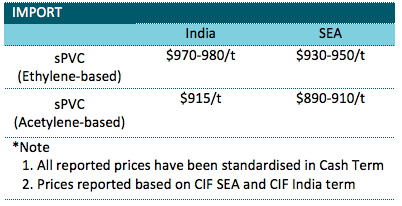

A summary of import PVC prices to the region is shown in the following table: