|

Asia Weekly PET Overview (Week 07, 13 - 17 February 2017)Asia Weekly PET Overview (Week 07, 13 - 17 February 2017) |

|

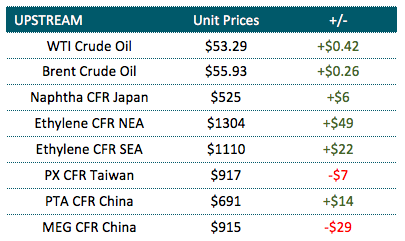

In Asia, small discount started to emerge in the import market after the long holidays as buyers are mostly consuming on hand cargoes and not ready to make fresh replenishment. Market is not expecting any large-scale price reduction in the near term as the upstream costs might sustain the firming trend and provide support to the downstream market.

Asia PX supply might be tightened during the second quarter, as the number of PX plants scheduled for maintenance shutdown is higher than last year. PTA market therefore, has full support from the cost side to advance further despite high operating rate at most regional major plants at the moment. According to private data, PTA inventory in local China alone has surged more than 200,000 tons throughout the Luna New Year holiday with an industry expert commented, “This does not appear to be a major issue in the medium term since both PET and polyester plants are ramping up run rate in March.”

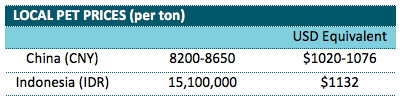

However, in the immediate term, couple of local suppliers in China has slashed PET prices by as much as CNY300/ton ($44/ton) from last week in the absence of most downstream bottle makers. A converter in the country informed, “We are still reinforcing the work force at the moment. End product orders have yet to come in, however we think business shall improve in the coming month. This week, our regular local supplier has reduced their offers three times and we plan to only make new purchases in the coming week.”

Another Chinese producer added, “We implemented some downward adjustment on both local and export cargoes this week, yet we are not planning for any significant price cut given high upstream costs at the moment. It is normal that buyers need longer time to revive normal operation rate after a long holiday, hence we hold optimistic view on near term outlook, especially the high seasonal demand from the bottle sector is just around the corner.”

Vietnamese converters confirmed receiving softer offers from several Chinese producers with a market source said, “Chinese PET is now offered at $1030/ton, CIF Vietnam, LC AS term and our supplier is open to negotiation. We believed that serious buyers could obtain at least $20/ton discount on deals. We have comfortable stock till April, hence might delay replenishment until March.”

There are some market talks about possible reduction in import duty for Chinese PET to Vietnam to 1 per cent from the current 3 per cent rate; however, there are no official documents from the Vietnamese government at the moment. Players are monitoring this news very closely as this could open up another export destination for Chinese suppliers amid increasing supply in the long run.