|

Asia Weekly PVC Overview (Week 09, dated 27 Feb - 3 Mar 2017)Asia Weekly PVC Overview (Week 09, dated 27 Feb - 3 Mar 2017) |

|

In Asia, most deals for March shipment have been concluded and players across the region are now watching out for the fresh offer indications. Demand in India continues to improve, however, outlook in Southeast Asia and China is less optimistic. Yet, the general expectation for April offers center around further price increment to all markets, except that the hike rate to Southeast Asia and China might be smaller than to India.

The most popular discussion among regional players called for $40/ton increased in offers for April shipment from a major Taiwanese producer, in line with the firming upstream costs and healthy demand in India. An Indian trader said, “It is likely that international suppliers might attempt to implement $40/ton increased in the coming month; yet the new prices could reach multi year high levels, which raise uncertainties about the acceptance among buyers. Meanwhile, demand in India is still improving.”

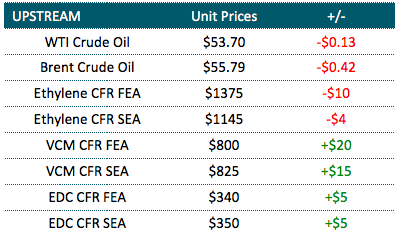

As mention in the previous report, inventory in China accumulated higher than expected in the post holiday period while restocking activities remain slow. In addition, constant softening futures trade has casted additional pressure on the spot market. This week, domestic carbide based PVC offers in China remained relatively stable with only CNY100/ton ($15/ton) discount for prices at the upper end of the overall price range, meanwhile ethylene based PVC prices shred CNY100-200/ton ($15-29/ton) week on week basis as traders attempt to smoothen sales process. It is reported that the on going environmental compliance inspection in the northern China area has forced a number of small to medium size converters to shutdown due to outdated wastage disposal system. This might further dampen market sentiment in the near term, sources said. “However, we hope improved demand during March-April period in other areas could balance up the condition. Firm stance from Taiwanese major would also support the general sentiment.” Export offers from China to Southeast Asia are also reportedly lower.

Most markets within Southeast Asia including Malaysia, Indonesia and Thailand are witnessing weaker than expected restocking activities and near term prospect appears to be less bullish. As a result, several regional and overseas suppliers have not been able to achieve full hike target for March shipment. In fact, buyers in Malaysia reported receiving discounts of $10/ton from initial prices for both Thailand and Indonesia PVC cargoes on the back of stiff buyer resistance. A pipe and profiles manufacturer in Malaysia commented, “Even carbide based PVC supplier has stepped back on their offers by up to $30/ton and we purchased some cargoes at $870/ton CIF Malaysia this week.”

In related production status news, Indonesia’s Asahimas delayed the maintenance shutdown schedule at its 150,000 tons/year No. 1 VCM line to July from mid-February and this is expected to ease the supply in the region.

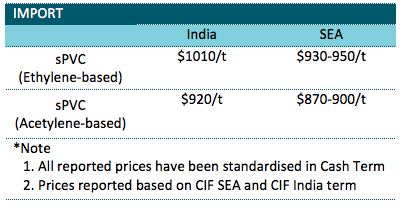

A summary of import PVC prices to the region is shown in the following table: