|

Asia Weekly PET Overview (Week 9, dated 27 Feb - 3 March 2017)Asia Weekly PET Overview (Week 9, dated 27 Feb - 3 March 2017) |

|

In Asia, PET offers continue to inch lower as a result of persistent weak buying interest across the region and also falling upstream costs. However, the near term outlook remain largely positive as the traditional high demand season draw near. Besides, a series of MEG and PTA plant shutdown might tighten supply in the region, which in turn play an important role in bringing the downstream PET market back on the firming track.

This week, comfortable supply in local China market as inventory accumulated during the holiday period has extended its downward pressure on the general sentiment. Domestic PET offers reportedly go down by another CNY100/ton ($15/ton) week on week basis with a beverage bottle manufacturer said, “We think market is still far from the bottom, therefore we plan to hold wait and see stance at the moment. Our end product business has yet to see any significant improvement. It is too risky to build up stock now.”

A producer said, “Besides the sluggish demand condition from the downstream converters, the upstream costs have also softened. We hope this situation is just temporary as the beverage sector would enter the seasonal high demand starting late March.”

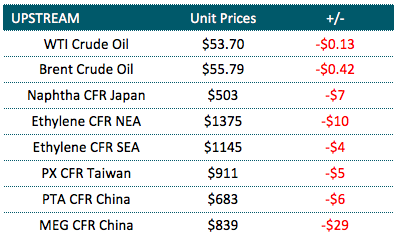

MEG costs based on CFR China term have been steadily decreasing since it hit the multi months high levels early February. In a time span of a month, MEG costs fell approximate $100/ton and might see additional discounts in the coming days. In the medium term, both MEG and PTA costs might regain the momentum in line with a series of plant shutdown. At least fifteen MEG plants in Asia and Middle East are undergoing maintenance shutdown from February to May, which might tighten supply once downstream plants ramp up production rate.

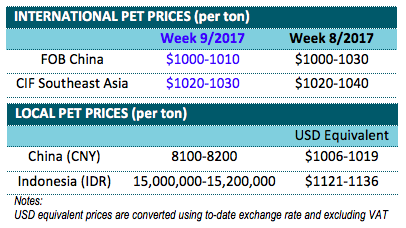

Persistent weak local market and falling monomers cost has also encouraged Chinese makers to slash export offers. According to CommoPlast data, PET prices based on FOB China term plunged $20-30/ton from last week to reach $1000-1010/ton FOB China term. Suppliers informed that prices below the $1000/ton threshold has yet to emerge, however, if the current demand condition remains in place in the near term, very likely that further discounts would become available.

Looking at Southeast Asia market, it appears that Vietnamese buyers are not very interested in making large replenishment claiming sufficient inventory. Despite softer import prices, many prefer to take wait and see stance. A bottle maker said, “Our end product business would normally pick up in April, therefore we hope to obtain additional discount before taking position in the coming week.”

Several Indonesian buyers have also expressed similar intention with a market source informed, “The final finding on the antidumping investigation on import PET from China will be announce in May. It is highly preferred that our cargoes arrive before such announcement regardless of whether the origin is subjected to ADD.” Besides, the preparation for the Ramadan season would soon to take place, in which market outlook for the second half of the month pretty bullish.