|

Asia Weekly PET Overview (Week 10, dated 06 - 10 March 2017)Asia Weekly PET Overview (Week 10, dated 06 - 10 March 2017) |

|

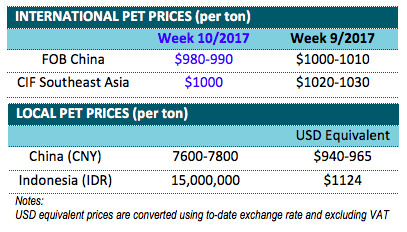

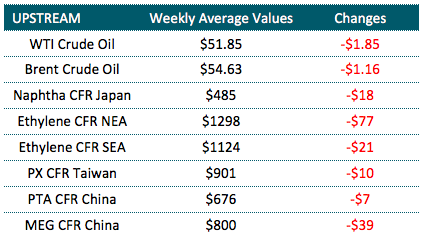

In Asia, suppliers continue to offers discounts on their available cargoes as demand sees little improvement from the previous week. Export PET offers from China breached below the $1000/ton threshold on the back of softening upstream costs. However, sellers are still holding tight on hope that buying interest would revive in the near term as the traditional high demand season draw near.

In domestic China market, inventories are reported to remain high as restocking activities has yet to pick up. Despite the spring is ending soon, temperature is still low which hurdle the stock preparation for summer among beverage bottle maker. A manufacturer commented, “Due to the extra month in Lunar Calendar this year, the traditional high demand season might delay slightly. We have yet to commit to any large replenishment even thought local suppliers are offering discounts.”

In fact, Chinese suppliers are stepping back on their offers to local buyers by up to CNY400/ton ($57/ton) week on week basis, bringing the lower end of the overall price range to about CNY7600/ton ($939/ton without VAT) EXW China, cash term. “Prices might continue to slide in the coming week if demand does not improve, especially at the current energy and upstream market condition. Therefore, we prefer to take conservative stance on fresh replenishment,” a converter added.

Bearish market condition in local ground has also encouraged Chinese suppliers to slash export offers by $20/ton, bringing latest prices to below the $1000/ton threshold, reaching $980-990/ton FOB China, LC AS term. A Chinese producer commented, “Upstream costs continue to soften amid slow restocking from converters. With the recent implementation of 5 per cent import duty on Chinese PET to Indonesia, situation might become more challenging in the near term.”

According to the Circular number Peraturan Menkeu 06/PMK.010/2017, signed by Indonesian Finance Ministry on 26 January 2017, import duties for polyethylene terephthalate (PET) to the country is lifted from zero (0) to 5 per cent with effective from 1 March 2017. However, material originated from Southeast Asia with Form D shall be exempted from the duties.

A buyer in the country commented, “Chinese material is becoming less competitive with the import duties implemented. We are monitoring closely the result of the on-going anti-dumping investigation on import PET from China and might replenish before May.” The source reported to have received offers for Chinese PET at $1000/ton CIF Indonesia, LC AS term. Domestic offers in Indonesia has also plunged IDR200,000/ton ($15/ton) on lethargic buying interest.

Meanwhile in Vietnam, market sentiment is negatively impacted by falling energy market with buyers tend to be very cautious. A bottle maker said, “Our suppliers are open to negotiation, however, we might postpone purchases to next week as it does appear that room for further reduction is still available.”