|

Asia Weekly PVC Overview (Week 14, dated 4 - 7 April 2017)Asia Weekly PVC Overview (Week 14, dated 4 - 7 April 2017) |

|

In Asia, there is little improvement in term of buying interest while weakening local PVC market in India is putting additional pressure on international suppliers. Asian players are mostly taking very conservative stance toward market outlook in the near term, especially when Chinese carbide based PVC offers unexpectedly fall to new low end.

In fact, Vietnamese buyers this week reported receiving offers for Chinese carbide based PVC at below the $800/ton threshold, reaching $790/ton CIF Vietnam, LC AS term. Although this offer is not very popular in the open market, it generated great concern among buyers. A converter in the country commented, “Event local producers are facing inventory pressure from which domestic prices has fallen to the range VND23,600,000-24,000,000/ton ($950-960/ton without VAT), FD Vietnam, cash term. Many traders are also holding high stock on hand, therefore, we think it might be difficult for import cargoes to firm up in the near term.”

Malaysian buyers have also adopted wait and see stance despite offers to this market remain mostly unchanged week on week basis. “We were initially planning to replenish some carbide based PVC at $820/ton CIF Malaysia term. However, with domestic market in India weakened, we decided to postpone our purchases to monitor further development.”

Indian buyers reported that a major domestic producer has slashed local PVC offers by INR3000/ton ($46/ton) from last month on persistent sluggish buying interest. A trader added that the price cut bring local PVC offers to around $965/ton EXW India, excluding VAT and excise tax, cash term – a level that is more competitive than import offers from Fareast Asian producers at the moment. The source said, “Depending on the purchasing volume, buyers might be able to obtain additional discounts. Therefore, it is very hard for international suppliers to compete in India this time.”

Buying interest in the country surprisingly remain soft, market players said and a number of buyers are expecting overseas suppliers to match the recent price cut from domestic suppliers for May delivery cargoes.

Chinese suppliers are loosing confident in the possibility that demand in Northern area could pick up due to rigorous controls on environmental compliance among factories here. Local offers see another CNY50-100/ton ($7-14/ton) drop for both carbide and ethylene based PVC with a trader said, “Inventories are piling up and we have yet to see any significant up-tick in demand. Buyers in the Southern and Eastern area prefer not to make large purchases to wait for additional discount to emerge.”

There are rumors that major Taiwanese maker is still having at least 20,000 tons of remaining cargoes from April to bring forward to May. And with the current supply-demand condition, market might remain under pressure in the coming week.

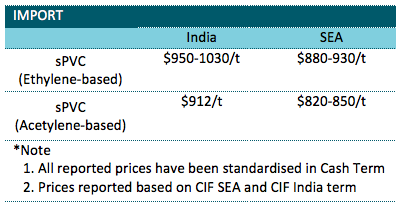

A summary of import PVC prices to the region is shown in the following table: