|

Asia Weekly PET Overview (Week 15, dated 10 - 14 April 2017)Asia Weekly PET Overview (Week 15, dated 10 - 14 April 2017) |

|

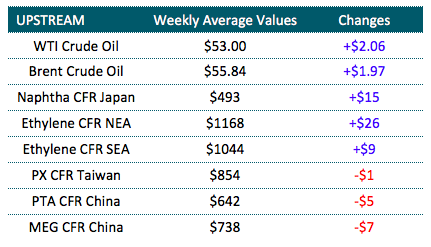

In Asia, there are some minor signs of an improvement in demand condition across the region though actual purchasing activities have yet to be strong. Couple of Chinese suppliers stepped back on their export offers on inventories pressure while many others elected to maintain firm stance on their cargoes. Players are divided on the near term outlook expectation with some pointing to stronger upstream costs and bright demand prospect in line with preparation for Ramadan to support the sentiment; while others fear of renewed pressure coming from new capacities in China.

As reported earlier, Hainan Yisheng Petrochemical is planning to bring the first phase of the new PET plant with capacity of 250,000 tons/year on stream by end of April. Meanwhile, Jiangyin Chengxin Industrial Group would start up the second phase of the new PET plant with capacity of 600,000 tons/year within second quarter this year. Great attention from local China market is putting on the start up progress of these new plants. Suppliers here offered CNY100/ton ($14/ton) discount on deals to encourage purchases. “However, we prefer to source hand to mouth basis as our end product businesses are just steady. Market might remain in the current position in the near term, hence we are not in rush to replenish large quantity,” a converter in Hangzhou reported.

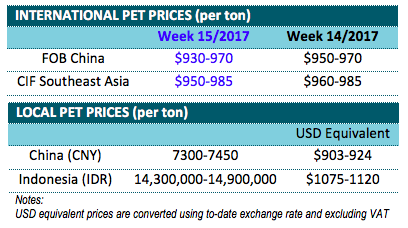

Export offers out of the country remain largely stable with only couple of suppliers initiated cut of $10-20/ton week on week basis, bringing latest prices to $930-940/ton FOB China, LC AS term. “We cut our offers this week with hope to speed up sales process. Local demand is still sluggish and with new capacities emerge, we fear that market might see additional price cut in the near term,” a Chinese producer said.

A majority of other Chinese suppliers attempted to hold offers unchanged at $970/ton FOB China, LC AS term. A maker reported, “Overseas buyers are not very attracted to our prices, however we might hold firm on the offers in line with stabilizing upstream costs. We think stronger energy market would also provide some support to the market in the coming weeks.”

Meanwhile, beverage bottle manufacturers in Indonesia reported seeing better number of end product orders this week while hoping to see continued improvement toward the end of the month. However, most purchases are restraint to local cargoes due to more competitive prices. A buyer received offers for Chinese PET at $985/ton CIF Indonesia, LC AS term commented, “After adding custom duties of 5 per cent, this cargo is higher than domestic material. We think buyers need more time to accept the hike from import market as many Indonesian converters are suffering from poor cashflow. This might also limit the extent of any price increment in the near future.”

Vietnamese buyers also reported stable offers for Korean and Thailand materials and several are more willing to enter negotiation with suppliers to make replenishment. A buyer received Korean PET offer at $1020/ton CIF Vietnam said, “Only the lower grade the maker offered at $1000/ton with the same term, and we are negotiating for $10/ton discount to make some purchases. Others are not showing intention to reduce offers.”

A summary of import and local PET prices to the region is shown in the following table: