|

Asia Weekly PVC Overview (Week 22, dated 29 May - 2 June 2017)Asia Weekly PVC Overview (Week 22, dated 29 May - 2 June 2017) |

|

In Asia, after a major Taiwanese producer sold out export allocation in the previous week, demand across the region remained below expectation. Indian buyers are withdrawing to the sideline to evaluate the impact of the newly introduced Goods and Service Tax (GST) on the market, stirring concern over the prospect for the near term outlook. Meanwhile, Chinese suppliers have stepped back on their offers to Southeast Asia in the face of stiff resistance.

Despite soft demand in India, a major domestic producer announced fresh offers with INR1000/ton ($15/ton) increased from last month, which many players attributed to the weakening Indian Rupee. A trader said, “Most buyers are paying more attention to import Iranian PVC cargoes at the moment, which are priced in the range $850-860/ton CIF India, TT 20:80 term. The increase in domestic offers therefore does not reflect the demand condition. We are not very confident about the near term market outlook.”

Reduced inventories pressure from the supplier's side is also attributed to the price decision as Reliance took one of the PVC line off-stream since 24 May for a scheduled turnaround. Another buyer added, "Local prices are now higher than import materials, which might attract less buying attention especially amid a series of financial concerns."

Within Southeast Asia, buying interest is not very strong and Chinese suppliers who lifted prices to this market in the previous week have now conceded to reduction. Import carbide based PVC fell up to $40/ton week on week basis this week, reaching $780/ton CIF Malaysia, LC AS term. However, it appears that buyers in the country are still not very eager to make replenishment. A profile maker informed, “Prices are still higher than last month which is not very attractive to us. Demand for our end products is pretty soft this month due to Ramadan and hopefully market condition could revive in July. We are still having some cargoes on hand, hence we might wait for additional discounts.”

It is also reported that Thailand producers lowered offers to Malaysia by $10/ton with hope to speed up sales process. A producer source added, “We have not been able to attract satisfactory number of deal in India as the GST is weighting on market confident there. Meanwhile, local Thailand market is amid the slowest season of the year, hence near term outlook is not very positive.”

Meanwhile, the effect of firming futures trading in domestic China market is fading, from which traders started offering discount of CNY50/ton ($7/ton) for both ethylene and carbide based PVC this week. “The on going environmental compliance inspection continue to affect demand, and we are just not optimistic about near term outlook,” a seller said.

It is heard that Tianjin Dagu Chemical Co Ltd was forced to lower operation rate due to environmental restriction. However, the company source was not available to confirm this news at the time this report is published.

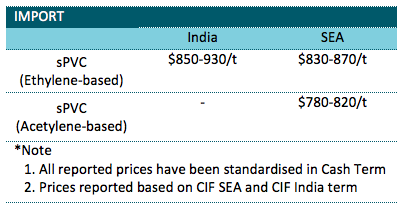

A summary of import PVC prices to the region is shown in the following table: