|

Asia Weekly PVC Overview (Week 38, dated 18 - 22 September 2017)Asia Weekly PVC Overview (Week 38, dated 18 - 22 September 2017) |

|

In Asia, a major Taiwanese producer announced October shipment offers to China and Southeast Asia at unchanged levels from last month, though deals are heard at discounts. Demand across the region is rather mediocre with China winding down replenishment activities ahead of the long National Day holidays.

Domestic offers for both ethylene and carbide based PVC in China fell another CNY100-200/ton ($15-29/ton) week on week amid falling futures market and slower than expected demand condition. Local offers currently stand at CNY7200-7400/ton ($937-963/ton without VAT) for carbide based PVC and at CNY8000/ton ($1040/ton without VAT) for ethylene based cargoes. “We are open to negotiation,” a trader said complaining disappointed sales result this week.

Supply for ethylene based PVC is reported to be tight with major producers remains operating at lower rate, which create a large price gap with carbide based cargoes. A producer added, “Spot market is still higher than futures trading at the moment, and arbitrage traders are leveraging the opportunity. We are not having high inventories on hand, yet still concern over the near term outlook.”

Even overseas suppliers are unable to keep prices stable compared to last month when it come to concluding deals in China. A Southeast Asian producer sold PVC parcels to China at $945/ton CFR, LC AS term added, “Current deals levels are $25/ton lower than last month and this is not very desirable. We hope that demand condition would improve after the National Day holiday.”

Demand in India has yet to revive despite a major Taiwanese producer stepped back on October shipment offers by $40/ton from last week, bringing the latest prices to $1010/ton CIF India, LC AS term. “There are no more discount available after the adjustment. Buyers are still very relax when it comes to making fresh replenishment. However, we believed that buying interest would continue to improve with monsoon season ending soon.”

Traders in the country are watching out for another price hike from a major domestic producer, which potentially pushing demand to a higher level.

Demand within Southeast Asia region remain soft with most deals are concerntrated on local ground. Taiwanese major rollover October shipment offers from last month and wiped out other supplier’s effort in lifting prices since last week. Malaysian buyers reportedly receiving down-adjusted offers from a Thailand producer by $10-20/ton from last week, to $950/ton CIF Malaysia, LC AS term. A buyer commented, “We also received offers for South Korean PVC at $945/ton CIF term and considering to make a small replenishment. India demand seems coming back, which might support the sentiment in the coming month.”

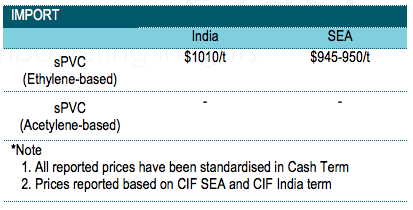

A summary of import PVC prices to the region is shown in the following table: