|

Asia Weekly PVC Overview (Week 39, dated 25 - 29 September 2017)Asia Weekly PVC Overview (Week 39, dated 25 - 29 September 2017) |

|

China demand waned, India and SEA holds steady on improving demand

In Asia, market is developing in diverged trend between as China is facing correction after an extended period of firming up while Southeast Asia and India are holding tight on the stable trend on improving demand condition. It is expected that demand in India might continue to revive in the near term in line with the end of the monsoon season, which might support prices throughout the region.

Local PVC prices in China started to slide since earlier this month after hitting the highest levels this year, CommoPlast data showed. Market deterioration seems quicken this week with local suppliers slashed offers for both ethylene and carbide based PVC grades by CNY200-300/ton ($30-45/ton) in the absence of buyers. “Many of our customers are leaving for the long National Day holiday, leaving market with little real activities. Room for further reduction is still there but limited, as supply remains tight,” a trader commented.

Players are expecting that the current downtrend might be stabilized soon with demand in overseas markets started picking up, which could reopen export windows for local producers. Another market source added, “Demand for PVC within China normally holds steady during the final quarter of the year and we are putting heavy hope on the post-holiday restocking activities. Market shall enter the stabilization state soon.”

In related news, 18 Chinese PVC producers were found guilty of violating anti-monopoly law by participating in price discussion and price setting during March 2016, resulting in more than 40% increased in local PVC prices in less than six months. All companies were fined accordingly.

In Southeast Asia, demand for ASEAN cargoes remain healthy in Malaysia as supply from China is restricted. However, compounding sector continue to take a lead over pipe sector in term of buying interest. “Besides, our Indonesian supplier is unable to fulfill all orders this month, therefore we need to source additional quantity from open market,” a buyer informed.

It is reported that demand in local Indonesia started to pick up amid tightening supply. “We have oversold cargoes in the previous two months and currently concentrating on clearing backlog. This has severely affected our export allocation this month,” a producer said. The source reported to have received good inquiries from Malaysian buyers and conclude deals at $20/ton higher than last month.

In India, market is stable to firm and major Taiwanese maker sold out PVC allocation to this market after stepped back on the hike target. “There are no further discount and buyers started coming back to make replenishment as the monsoon season ended. We expect demand to continue improving in the near term, especially if domestic producer lift prices one more round,” a trader commented.

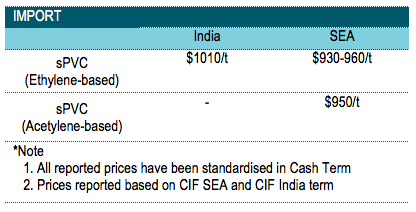

A summary of import PVC prices to the region is shown in the following table: