|

Asia Weekly PVC Report (Week 12, 14-18 Mar 2016)Asia Weekly PVC Report (Week 12, 14-18 Mar 2016) |

|

In Asia, PVC market firmed up this week following a price announcement from a major Taiwanese maker that read an increase of $50/t to India market and $30/t to Southeast Asia and China compared to last month. Other regional producers have also implemented similar hike on their cargoes.

Indian market retains a very strong momentum as the seasonal high demand for PVC on going. In fact, the Taiwanese major sold out their cargoes in less than an hour after the new price announcement. A trader in this market commented, “We were not fast enough to purchase any of the Taiwanese cargoes this round as the producer sold out too quickly. Supply from Japan is tight and Iranian cargoes should also be limited due to the long holidays from 18-26 March. Demand is good at the moment and we think this trend might continue in the coming month”

Both carbide and ethylene based PVC producers in China have also lifted their export offers to Asia market this week while sluggish domestic demand has encouraged sellers to pay more attention to export activities. A trader lifted offers for carbide based PVC to $7760-770/t FOB China, LC AS term said, “Buyers are resisting our new offers as they complain the offer is a little too high. We are planning to hold firm stance on our cargoes as producers are planning to implement additional hike on their prices next week.”

In Southeast Asia, demand remained stable yet supply within the region appears to be not very comfortable.

Indonesia’s Asahimas Chemical has restarted their plant after the expansion project, however its VCM line is reportedly operating at 50 per cent capacity, which put a check on their PVC output. Market sources added that one of the Thai majors is also having production hiccup, adding to the tightness in the region. A Malaysian pipe manufacturer said, “Our Japanese supplier is not allocating any cargoes to SEA market this month due to limited cargoes stemming from a scheduled maintenance shutdown at their plant this May and more attractive prices in India market. We have sufficient cargoes till May and we would negotiate with our supplier for better prices.”

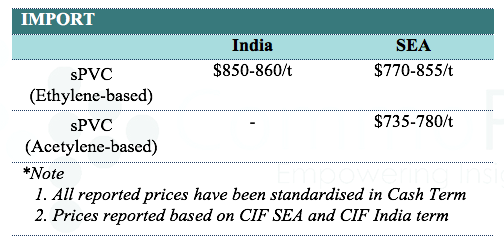

Most players are expecting firmer trend in the coming days with Taiwanese major expressed intention for further price hike next month. A summary of import prices to SEA and India market is shown in the following table:

A summary of import prices to SEA and India market is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website atwww.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.