|

Asia Daily PP PE Report 13 Jan 2016Asia Daily PP PE Report 13 Jan 2016 |

|

In China, PP futures prices on Dalian Commodity Exchange for May delivery increased CNY16/t ($2.5/t) to settle at CNY5576/t ($724/t without VAT). Same contract for LLDPE futures reduced CNY25/t ($3.8/t) to reach CNY7790/t ($1010/t without VAT).

Physical spot offers for domestic PP and PE did not see any drastic changes with producer’s price list remains unchanged, however, traders selectively giving CNY50-100/t ($8-15/t) discount on certain cargoes to entice buying interest. A trader active in PP market commented, “Sentiment has turned sour with the weakening of energy market. Buyers are very cautious when it comes to making fresh purchases. We expect local inventory to increase over the near term if demand does not improve before the holidays.”

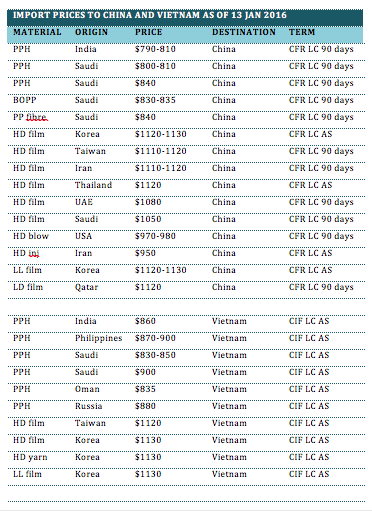

Import homo-PP to China today couldn’t sustain the stable trend, which many have expected along with a number of plant outage reported recently. Weak demand overshadowed the supply concern, causing traders to cut their homo-PP offer by approximate $20-30/t compared to last week.

In the PE market, local players informed Shenhua Baotou Coal Chemical Co has successfully produced on-spec LLDPE grade after a short period of having technical difficulties. This helps to unwind the tight supply condition taking since mid Dec 2015 for this grade. A trader in Shanhai said, “We are more willing to negotiate with serious buyers, however, it is pretty difficult to conclude deal this week. We expect to see a pick up in demand only after the Chap Goh Mei celebration in 22 Feb 2016.”

In Vietnam, more activities are observed in the PP market today with a number of overseas suppliers open new offers. A buyer purchased Saudi homo-PP at $830/t CIF Vietnam, after $20/t discount from initial offer said, “We purchased some quantity from our regular supplier and the market is generally still accepting this price level.” Another buyer purchased Middle East homo-PP at $835/t CIF term added, “We did not replenish this origin in large quantity but we are negotiating for non-dutiable cargoes to buy in volume. Local prices have softened a bit compared to last week but demand is still steady.”

Elsewhere, players in Indonesia reported that both of local producers have adjusted their PE price down by $20-30/t compared to the beginning of the week. A converter purchased local HDPE film at $1200/t FD Indonesia, cash said, “We only buy a small quantity as we feel uncertain about the market outlook in the near term. We think that sellers will not reduce price significantly with the support from firm ethylene costs.” Another trader added, “Our supplier is willing to give additional discount even after the price reduction today. We remain cautious about the market outlook in the near term.”

The currency depreciation also hurts buying interest in Malaysia with most buyers are showing hesitation toward import cargoes. A converter reported, “We continue to buy on hand-to-mouth basis and we expect price to follow largely stable trend in the near term. Demand for our end product is regular at the moment.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us atcommoplastinfo@gmail.com for assistance.