|

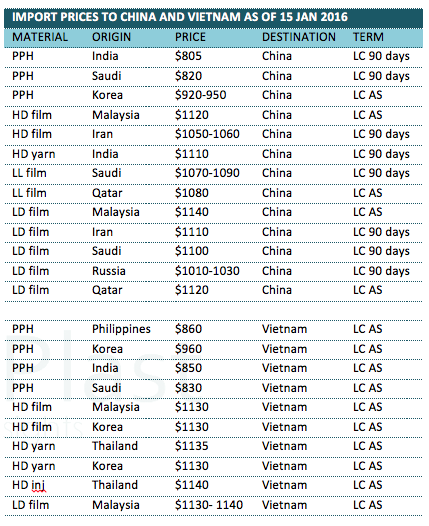

Asia Daily PP PE Report 15 Jan 2016Asia Daily PP PE Report 15 Jan 2016 |

|

In China, futures contract for May delivery on Dalian Commodity Exchange today settle higher compared to the previous trading session. PP futures gain CNY41/t ($6/t) to reach CNY5695/t ($740/t without VAT) and LLDPE futures increase CNY40/t ($6/t) at CNY7790/t ($1010/t without VAT).

Spot offers for PP in domestic market are reported at CNY100/t ($15/t) higher than yesterday with players attributed the gain to the extended upturn in futures trade. PE is on the south side as sellers promptly respond to the plunging ethylene cost in Asia these two days. A trader in Shanghai shared, “There are speculations that PP market has reached the bottom, but looking at the current volatile upstream market, we elected to reduce PP trading quantity.”

Sudden downturn in ethylene costs is doing no good to the market, forcing local majors to cut price by CNY100-200/t ($15-30/t) in spite of tight supply condition, especially for LLDPE film cargoes. Most players, who have been contacted by CommoPlast today, are very concern about the market outlook in the coming week. A source in Linxi reported, “We are on the wait and see position now as we expect further downward adjustment in the coming days.”

In Vietnam, a quiet sentiment sweeps through the PE market today as buyers develop more hesitation after the upstream values dropped drastically. Local prices weakened slightly while a majority of overseas suppliers are still maintaining very firm stance on their cargoes. A trader commented, “We feel very uncertain about the market outlook in the near term, therefore we plan to postpone our replenishment activities. Our Thai supplier is very reluctant to adjust their offer while we are receiving some discounts from other sources today.” Market players also reported the apparent of re-export Iranian HDPE inj cargoes from China to Vietnam.

There is little movement in the import PP market; however, players in Thailand and Vietnam are reporting lower local prices. A Thai trader offers local homo-PP at THB35000/t ($960/t) for yarn and injection grade and THB35500 ($975/t) for film grade, FD Thailand, excluding VAT said, “Our principal supplier will be having a 10-days maintenance shutdown starting next week, but we are not having enough confidence in market outlook in the near term. Demand is just too sluggish.” Another seller in Vietnam added, “Local offers are weaker after a brief gain last week due to volatile upstream market. Most of buyers are waiting on the sideline, showing very limited interest in making fresh purchases.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us atcommoplastinfo@gmail.com for assistance.