|

Chinese government lifted export tax rebates to ease pressure on local companiesChinese government lifted export tax rebates to ease pressure on local companies |

|

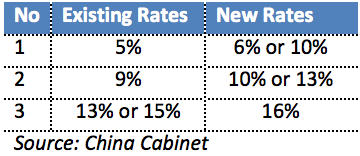

It is reported that the Chinese government would increase the export tax rebates for exporters by 1 to 3-percentage point starting 1 November 2018 in an attempt to ‘support foreign trade and ease pressure on local companies amid complex international situation’. The tax return procedures will be simplified and shortened from 13 days to 10 days by year-end.

Three categories of export goods and services would enjoy the new incentive:

This is the second time this year the same measurement has taken place. In September, the Chinese government also lifted the export rebate rates for 397 items, including most of the petrochemical products bearing HS code 3901, 3902, 3903, 3904, 3905, 3906, 3907, 3908 and 3909.

This time, the full list of products that could enjoy the new incentives has not been published. However, it is regulated that rebate rates for high energy-consumption and seriously polluting goods, as well as those involved in industrial capacity, would remain unchanged.