|

Asia Weekly PVC Report (Week 18, 25-29 Apr 2016)Asia Weekly PVC Report (Week 18, 25-29 Apr 2016) |

|

In Asia, the PVC market wrapped up May business this week and there are little changes in prices reported as most players were attending ChinaPlast event. Players are now discussing about possible market direction for June business.

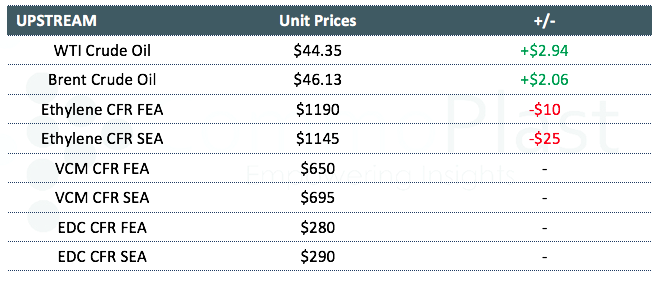

In India, Reliance reportedly restarted its 345,000t/year PVC plant in Dahej after a weeklong shutdown due to water supply shortage. However, players are reporting seeing minimal impact of the shutdown on local supply, thanks to arrival of previous cargoes and slower than expected demand. A market source commented, “The strong buying momentum market see past month has hit the brake, yet we are not expecting any reduction in the near term. However, there might be some downward adjustments for June business if ethylene costs continue to move lower in May.”

Sentiment is especially slow in China during a short trading week. Although there is very limited trading activities observed; sellers refused to give discounts on the support of firming futures market. An ethylene-based PVC producer commented, “Most of our domestic buyers are away from their desks for ChinaPlast, hence our sales is very disappointed. Looking ahead, we are not very optimistic about May outlook given sluggish demand in SEA market and weaker buying interest from India.”

Meanwhile, players in Southeast Asia reported no better condition than other major market in the region with an international trader added, “Our regular customers claimed to have sufficient material for May production, hence prefer to wait on the sideline. Upstream costs are still high which might keep the downstream market relatively stable in the coming week. On the other hand, we think market might not increase any further given diminishing demand in major regional markets.”

In the Plant Status news, Korea’s Hanwha Chemical Co Ltd and Japan’s Shin-Etsu Chemical Co Ltd planned a month-long maintenance shutdown at their plant in May 2016. Both plants have annual capacity of 300,000 tons/year and 550,000 tons/year respectively.

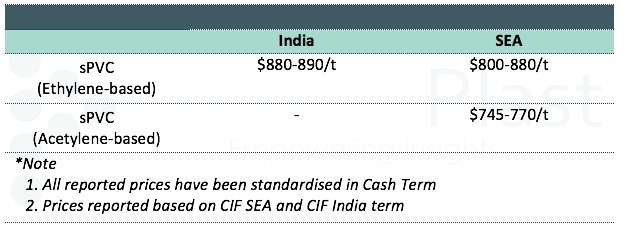

A summary of import PVC prices to the region is shown in the following table: