|

Asia Weekly PVC Report (Week 20, 09-13 May 2016)Asia Weekly PVC Report (Week 20, 09-13 May 2016) |

|

In Asia, most sellers have settled with May business this week and are now planning for June shipment offers. Players continue to hold the stable trend expectation despite weaker demand in major markets, citing regional production issues as the primary support.

In India, Reliance is reported to have shut its Dahej plant again today due to recurring issues of water supply shortage. The plant has an annual PVC capacity of 315,000 tons/year. The monsoon has started at some part of the country, causing visible slow down in trading activities, yet traders are attempting to maintain firm stance on their cargoes, players reported. A market source informed, “We think production issues at Reliance plant might keep domestic supply on check in the coming day, in which the producer has elected to maintain local offer stable at mid of the week. This might provide support for major Taiwanese to keep prices unchanged from last month.”

Demand in China is reported to be lethargic, however firmer futures prices throughout the week has encouraged sellers to maintain their domestic prices unchanged. A carbide based PVC producer commented, “We have not been able to close satisfactory number of deal this week, however, we are not planning to give large discount as carbide costs continue to move up, squeezing our margins.”

There are very limited trading activities observed in the Southeast Asia market with buyers mostly on the side-line waiting for fresh price announcement from Taiwanese producer. A regional producer added, “We have completed May business but yet to open offers for June. Demand within the region is diminishing, however, we think that several plant issues might help to support the market in the coming days.” Market is expecting mostly stable offers from international market, yet buyers are also not excluding larger discount on deals possibility amid weakening buying interest.

In the Plant Status news, Indonesia’s Asahimas has announced expansion plan at its PVC unit, in which another 100,000 tons/year would be added to the current nameplate capacity by 2018. By then, Asahimas would have total PVC output of 700,000 tons/year, mostly to satisfy domestic demand.

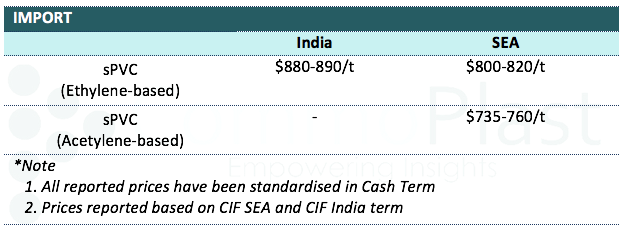

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.