|

Asia Weekly PVC Overview (Week 26, 20 - 24 June 2016)Asia Weekly PVC Overview (Week 26, 20 - 24 June 2016) |

|

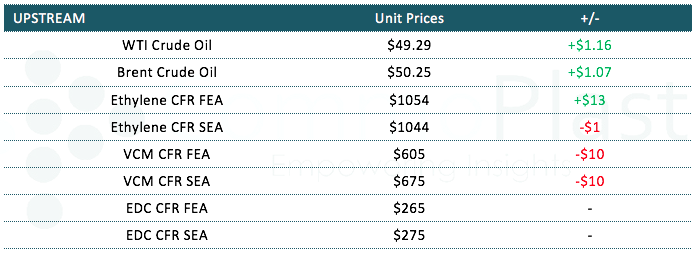

In Asia, the PVC market turns south this week with a Taiwanese major down adjusted their July delivery cargoes by $30/ton to all market to reach $770/ton CIF Southeast Asia and China market and at $830/ton CIF India, all based on CIF, LC AS term. It is interesting that regional buyers believed market has reached the bottom, which stimulated purchasing activities in spite of the traditional slow demand season.

In India, buying interest surged impressively on the fact that major Taiwanese producer has cut allocation by 60% compared to normal month at only 12,000 tons, market sources said. Scheduled shutdown at the producer’s plant in August is expected to tighten supply further, hence many buyers decided to replenish cargoes though end product demand remains disappointed. A trader said, “Our Korean supplier refused to give any discount from initial offer at $850/ton LC 90 days term give lack of supply in general. Many other customers have turn to Chinese carbide based cargoes or other irregular origins to secure sufficient stock level. We think market has found its way to rebound from the recent low.”

In China, domestic demand appears to be stagnant, yet continuous firming futures trade throughout this week has given sufficient encouragement to local producers to lift prices even with softer international market at the background. A carbide based PVC producer said, “We have up adjusted our offers by CNY50-100/ton ($8-15/ton) but the initial respond is not very good. However, looking at the strong buying appetite in the nearby India market, we think market has touched the bottom. We plan to hold firm on our cargoes hoping to see better demand in the near term.” Not only domestic price increased, carbide based makers also lifted their export offers by $10/ton to reflect better margin in domestic ground. Ethylene PVC maker meanwhile adopted more conservative view from which offers are mostly unchanged from last week.

Southeast Asian market also gain the spillover effect from better than expected demand in India, from which buyers are showing stronger intention to make fresh replenishment. A converter in Malaysia received offer for Chinese carbide based PVC at $730/ton CIF Malaysia, LC AS term informed, “Our supplier is not willing to negotiate for any discount which narrow the price gap between ethylene based and carbide based cargoes. We are planning to talk with our supplier to take some quantity as we expect market has reached the bottom.”

Market sources added that major Taiwanese maker recently entered a business contract to supply sPVC to Australia after Australian Vinyls Corporation decided to permanently shutdown its 140,000 tons/year PVC unit earlier this year. Australia thereafter become net importer for PVC.

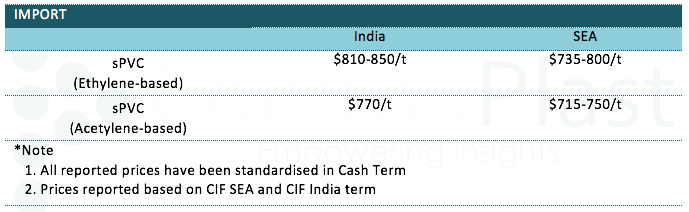

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.