|

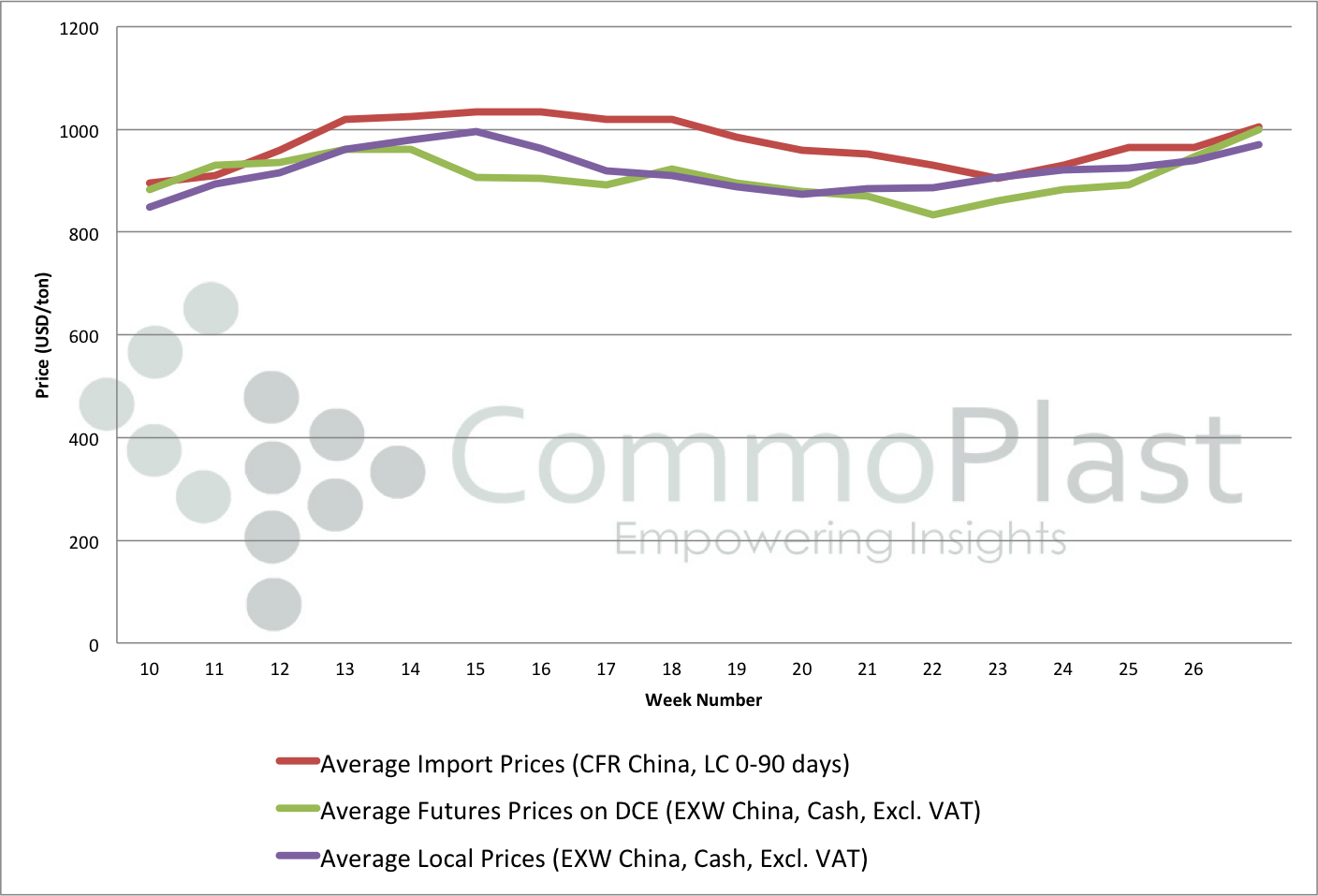

Import homo-PP below $1000/ton fades in China, sustainability in questionImport homo-PP below $1000/ton fades in China, sustainability in question |

|

After an extended period of down trend, import homo-PP prices to China started to pick up in early June and this week, prices below $1000/ton threshold have technically disappeared from the market. Players attributed the continuous firming trend in the past three weeks to the solid support from supply tightness and surprisingly strong futures trade on Dalian Commodity Exchange.

A trader sold Saudi Arabia homo-PP at $1000/ton CFR China, LC 60 days term today said, “Demand for import cargoes in fact is not as healthy as expected, yet we are not having any sales pressure to commit to discount.”

This could be explained by the fact that import cargoes are constantly facing pressure from competitive local materials, which are averagely $30-35/ton lower than the USD market at the time this report is published. To make the matter worse, the Chinese Yuan has depreciated most in 10 months, according to media reports, as a result of the Brexit butterfly effect on the global financial market. Chinese players are now expecting domestic prices to pick up, in line with drastic upward movement observed on the Dalian Commodity Exchange recently. A market source said, “We have not seen any factor that could possibly drag down the market in the first half of July; however, market might be bumped in the medium term without the support from the demand side.”