|

Asia Weekly PVC Overview (Week 27, 27 June - 01 July 2016)Asia Weekly PVC Overview (Week 27, 27 June - 01 July 2016) |

|

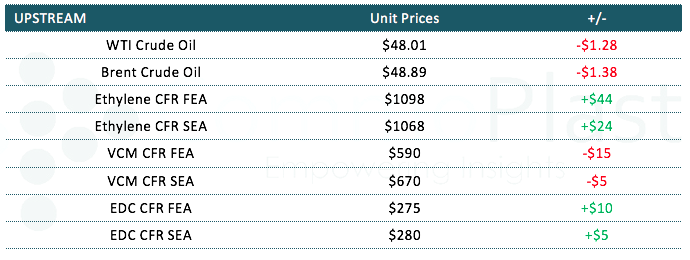

In Asia, most suppliers have concluded July businesses after announced new offers with reduction last week following the trend pioneered by a Taiwanese major. However, due to reduced availability, many producers decided to stand firm on their prices, which help to minimize the price reduction range. Industry players are generally expecting a rebound in the coming month given better than expected demand in India market.

In fact, buying interest in India is surprisingly healthy in spite of the monsoon season, which traditionally regarded as the downturn of PVC demand cycle. A Southeast Asian producer informed, “We have sold out July cargoes to India even after an increase in offer of $10/ton. Today, we are still receiving a good number of purchase inquiries from buyers in the country. We think supply might be tightened further in the coming month with the maintenance shutdown at Formosa’s plants. For this reason, we expect to see higher prices in the near term.” A trader in the country confirmed the robust demand condition saying, “Buyers are technically running out of option as most ethylene based PVC cargoes are sold, in which they are turning to carbide based cargoes to maintain inventories levels. This aggressive buying during the off-peak season is rare to come-by, which we think could be due to low stock levels on importer’s hand.”

In China, strong futures market continues to support the firm sentiment though actual demand from converter remains subdued. It is reported that domestic offers added another CNY50/ton ($8/ton) on carbide based PVC cargoes while ethylene-based parcels are mostly unchanged from previous week. A trader commented, “Local supply is not ample as most plants are operating at reduced rate in compliance with government environmental regulation. This, however, is counterbalanced by mediocre downstream demand. The distribution market becomes more active recently as traders believed that near term outlook is positive given improved demand in major overseas market.” Carbide based cargoes has also gained ground in the export market, adding $10/ton from last week to reach $750-760/ton FOB China, LC AS term.

Demand in Southeast Asia market has yet to see strong come back, yet the spillover effect from healthy buying interest in India is lifting the whole sentiment. A Vietnamese buyer purchased Japanese cargoes at $780/ton CIF Vietnam, LC AS term informed, “We also received offer for USA cargoes at $760/ton with the same term and currently considering to enter the deal. We think the market is having quite a support to advance further in the coming months though domestic demand at the moment is not that great.” Meanwhile, Malaysian players received higher Chinese carbide based PVC offers, but decided not to proceed further given slow end product business during the Ramadan season.

In the plant status news, Japan’s Tosoh has restarted its 250,000 ton/year no.1 VCM line in Nanyo this week after completed a 45 days maintenance shutdown. However, the company is planning to overhaul its 600,000ton/year no.3 VCM line in September for 45 days.

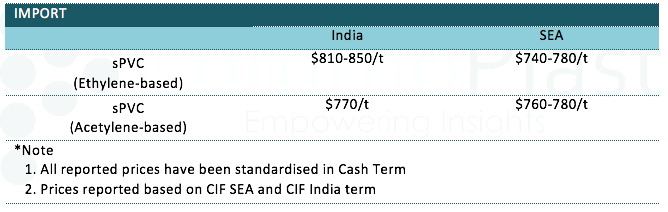

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.