Asia Weekly PVC Overview (Week 30, 18-22 July 2016)

Asia Weekly PVC Overview (Week 30, 18-22 July 2016)

India market continues moving higher, regional demand remain healthy

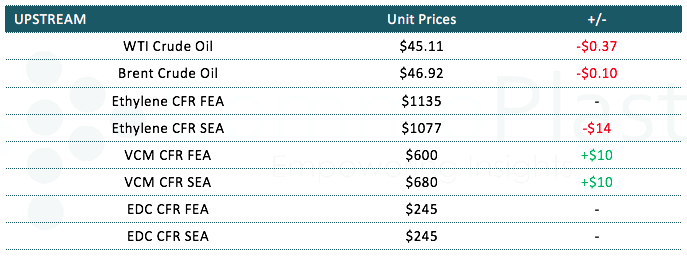

In Asia, market remained relatively strong though buyers in Southeast Asia and China have mostly completed purchases for August delivery cargoes. Demand in India persists on the positive side and playing an important role in lifting the general sentiment. Despite the fact that the return of several major crackers are pulling ethylene costs down, industry players are holding firm expectation for continued improving demand condition.

In India, after concluded business with a major Taiwanese maker in the previous week at $40/ton hike from last month for a significantly small allocation; this week a Korean maker announced fresh price list with some $55-65/ton increased from last month to reach $950-910/ton CIF India, LC 90 days term. Buyers are showing strong resistance towards this offers in spite of lacking availability and better than expected demand. A trader offer on behalf of the producer informed, “We have not been able to conclude any deal at the new offers. Many customers are trying to search for carbide-based cargoes at more competitive prices. We think buyers might take sometime to accept higher levels, hence we prefer to hold firm on our parcels.”

In China, domestic offers remained unchanged after continuous price increment in the past two consecutive weeks. An ethylene based PVC producer in the country commented, “Unlike India, we are not seeing such strong sentiment in domestic market since most converters claimed seeing slow end product business. However, we continue to achieve good export business and we are not facing any sales pressure as our plant could only operate at 70% capacity. Our domestic customers have been keeping low stock level throughout the off-peak season, hence we believe trading activities would improve in the coming month.” Export offers out of the country reported to gain $10/ton compared to the earlier week, thanks to strong buying interest in India.

Sentiment in Southeast Asia appears to be a little lag behind other major market this week as converters claimed to have sufficient material while the monsoon season dampens buying interest to a certain extent. A trader offered Thailand PVC at $815/ton CIF Malaysia, LC AS term said, “Our regular customers mostly skipped purchasing this week on sufficient inventories from previous replenishment. Our principal is very firm on their offer as they find good support from other markets.” Meanwhile, a regional converter purchase Chinese carbide based PVC cargoes at $755/ton CIF said, “With this procurement, we have sufficient material till mid-September. Market might sustain the current firming trend in the near term, however, our end product business might not improve immediately.”

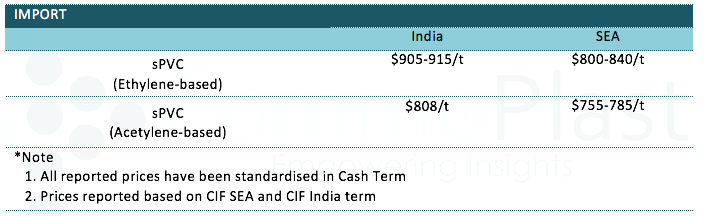

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.