Asia Weekly PVC Overview (Week 31, 25-29 July 2016)

Asia Weekly PVC Overview (Week 31, 25-29 July 2016)

PVC offers moved north, demand in India softening

In Asia, most suppliers have sold out August cargoes and now planning for the next price announcement. However, players are expecting stable to firmer trend in the near term with the support from limited supply stemming from several shutdown in Fareast Asia region. It is worth noting that demand in India is showing sign of slowing down and prices at the upper end of the overall price range are facing stiff resistant. This might limit the extent of price increment in the coming month, players said.

Buyers in India reported receiving fresh offers for Japanese PVC cargoes at $930/ton CIF India, LC AS term, excluding anti-dumping duties of $15/ton; yet, respond from the market is not as good as expected. A trader commented, “Demand is weaker as supply is normalizing. One of major domestic maker is now supplying full allocation to local market after several months having plants issues. We think market would remain on the stable trend in the near term and that demand might pickup again after the monsoon is over.”

In China, most sellers claimed to have sold out their available allocation at CNY50/ton ($8/ton) higher than last week thanks to healthy sentiment in the international market and firming futures trading. Players in the country are expressing a general positive outlook for August claiming low inventories levels on buyer’s side while domestic production adjustment during the G20 Summit would tighten supply further. An ethylene based PVC producer commented, “We expect demand would continue to improve in the near term as the traditional high demand season is just around the corner. Meanwhile, shutdown at one of the Taiwanese plants might reduce availability in the import market. For this we expect to see a more of stable to firm trend in the coming months.”

Meanwhile, international traders claimed to have good sales not only in Asia region but also in Iran and Middle East this month. This is expected to strengthen the support for the firm trend in the near term, sources said.

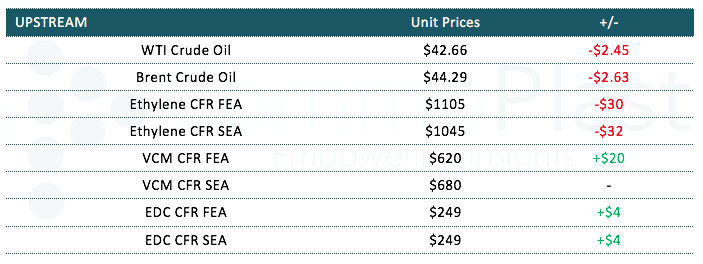

Despite demand in Southeast Asia is weaker than other region as the typhoon season hit part of the region, players are also sharing similar view regarding the market prospect given the lack of inventories pressure at the seller’s side. A regional converter informed, “Our end product business is not encouraging and we replenished sufficient material till Oct. Our Korea suppliers are diverting the focus to India market due to better margins in that country, for this we did not receive any offer for Korean material this round. Besides, we think non-integrated producer might also face costs pressure with firming VCM costs stemming from several plant shutdowns in the Fareast region, which encourages firmer stance on their cargoes.”

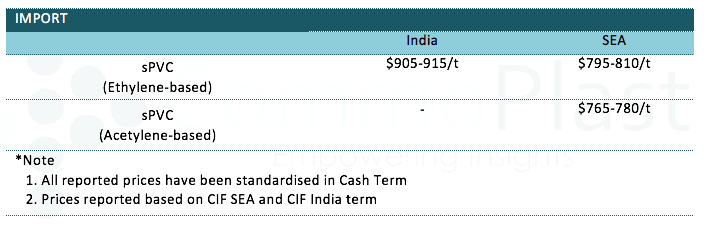

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.