Asia Weekly PVC Overview (Week 32, 01-05 August 2016)

Asia Weekly PVC Overview (Week 32, 01-05 August 2016)

Firmer expectation amid softer demand in major markets

In Asia, market remains relatively stable this week with very limited trading activities as players have concluded businesses for August and currently waiting for Taiwanese major to announce September shipment prices, which normally takes place during mid of the month. Market participants are voicing their expectation for the new offers, mostly at higher levels, citing limited availability as the primary support.

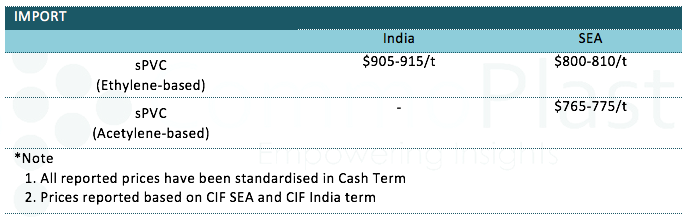

There are little movement observed in the India market as buyers are showing diminished purchasing interest in line with the improved local supply since a major domestic producer resumed production. A trader in the country commented, “Most import offers above $900/ton threshold are facing strong resistance. Buyers claimed to have sufficient inventories by now while end product demand has yet to show any pick up during the monsoon season. We think for this, there might be only some upward adjustment for prices at the lower end of the overall price range, while the upper end levels might follow more of a stable trend with the support from firm upstream costs and reduced import availability.”

In China, domestic spot offers continue to journey north, adding another CNY50-100/ton ($8-15/ton) from last week with the support of strong futures trade. Players are not seeing any issues on the supply side, however, carbide based producers reported higher cost pressure stemming from tightened environmental control. Most market participants in China expected to see better demand in the coming month as PVC applications enter the high demand season. An ethylene based PVC producer commented, “We are holding very low stock at the moment, which allowed us to achieve full price hike target without much hurdles. Most PVC converters would operate throughout the National Holidays during first week of October, hence we think demand prospect in September is really positive.”

Discussing with several international traders regarding the outlook for September, sources are expecting some $20-30/ton hike from a major Taiwanese producer due to a scheduled turnaround at its plant this month, which would limit the impact of slower demand in India and Southeast Asia. Meanwhile, several markets in Southeast Asia region are in the mid of monsoon season that discourages replenishment activities. A trader cut carbide based PVC offers by $5-10/ton from last week to reach $770-775/ton CIF SEA, LC AS term said, “Our regular customers are not showing much interest even with the latest discounts, claiming weak end product demand. We are really not confident that market could accept higher price levels at the current condition.”

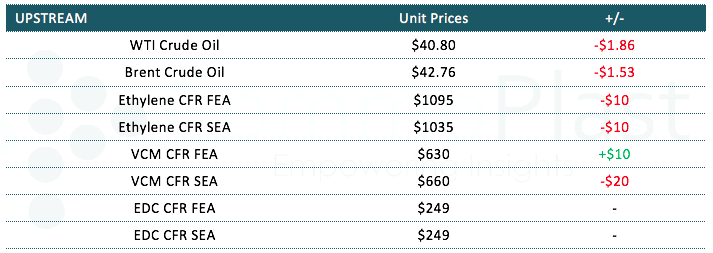

In plant status news, two VCM plants in Fareast Asia might overhaul during September, which is expected to push VCM costs higher. Japan’s Tosoh schedules a 45 days shutdown at the No.3 VCM line with capacity of 600,000 tons/year while Taiwan VCM also plans to shut its 420,000 tons/year VCM plant in the same month.

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.