Asia Weekly PVC Overview (Week 38, 12-16 September 2016)

Asia Weekly PVC Overview (Week 38, 12-16 September 2016)

Limited trading activities in holiday’s week, new offer awaited

In Asia, the PVC market is quiet this week as players in major market including China and Korea are away to celebrate mid-Autumn festival. It is expected that major Taiwanese makers would announce fresh offers by next week, and factors supporting firming trend is so strong that many players have upgraded their expectation for price increment from 20-30/ton initially to $30-40/ton this week.

Indeed, supply is tightening in the region not only due to the delay in shipment as reported in the previous week, but also due to the recent production issues at regional major plant. Players reported that Taiwan’s Formosa has cut operation rate at its PVC line due to insufficient ethylene supply stemming from the maintenance shutdown at its naphtha cracker. It is unclear on when the unit would resume regular operation rate, yet this have boosted market expectation for higher prices.

An international trader informed, “There are chances that our Taiwanese supplier might reduce export allocation again this month, and we are expecting some $30-40/ton hike as a result of lacking sales pressure.” Another Indian trader added, “Market is all quiet, waiting for new prices. We think buyers might continue to replenish material as market is left with very limited availability from overseas suppliers. However, We are not very confident about October outlook given the upcoming Diwali holidays.”

After nearly two consecutive months of continuous price increment, local PVC market in China seems not loosing any of its steam up to this week as suppliers see no obstructions in implementing further hike. Indeed, domestic offers for both ethylene and carbide based PVC are up CNY100-200/ton ($15-30/ton) compared to last week and buying interest remain resilient. Higher production costs stemming from tightened environmental control rules and regulations left carbide based PVC makers no choice but to lift prices to defend their profit margins. A maker from Inner Mongolia said, “Not only feedstocks are higher, transportation costs also swelled. This week, we increased our offers by CNY100-200/ton ($15-30/ton) and we managed to close a good number of deals to local buyers.” The producer also lifted export offers by $10/ton to reach $830/ton FOB China, LC AS term. The source added, “Our Southeast Asian customers are not very responsive to the new price levels, yet we would prefer to hold firm stance on our cargoes on the back of lacking sales pressure.”

There are very limited trading activities in Southeast Asia market though the peak seasonal demand is just around the corner. Most pipe and profile makers in Malaysian and Indonesia reported not seeing any improvement in their end product demand. Meanwhile, a Philippines trader informed, “Local demand for PVC is satisfactory mostly due to supply tightness. There are some production issues at one of the local producer, though we are not very clear on the current status of the plant. We think this condition might sustain in the near term.”

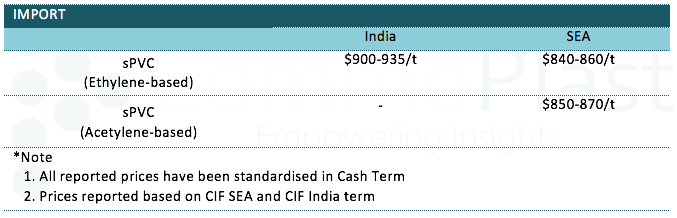

A summary of import PVC prices to the region is shown in the following table: