Asia Weekly PVC Overview (Week 39, 19 - 23 September 2016)

Asia Weekly PVC Overview (Week 39, 19 - 23 September 2016)

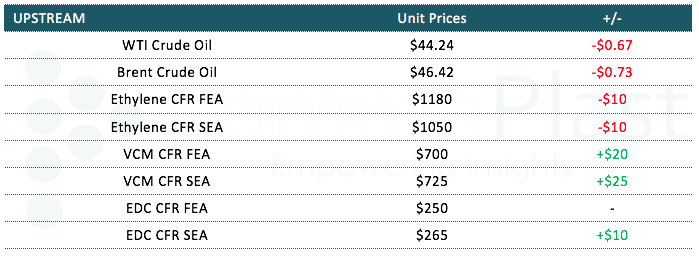

In Asia, market is happening this week as major Taiwanese maker implemented $40/ton hike on October delivery cargoes, higher than many players’ expectation. This is due to limited availability and the producer itself has reduced operation rate due to lack of ethylene supply as reported earlier. Meanwhile, it is reported that purchasing activities in major markets including China and India remain healthy as the peak seasonal demand starts.

Not only that hike target for October is above market expectation, the suppliers also managed to sell out all available quantity to India market just a day after the new price announcement. A trader in the country purchased the cargoes at $950/ton CIF India, LC AS term informed, “Our supplier concluded deal without any discounts. We and few other traders are requesting for additional quantity but not sure if there would be any available cargoes. Demand is healthy here and we think this condition might improve in the near term since pipe and profile converters are expecting a pick up in end product business after the Diwali festival.”

On the other hand, other international suppliers are attempting to test market respond by offering to India at $10-20/ton higher than the Taiwanese major. However, buyers here are not showing much respond. A trader received Japanese PVC offers at $970/ton CIF India, LC AS term said, “We think this offer is too high as it excluded the anti-dumping duties.”

Meanwhile in China, local offers skyrocketed for both carbide based and ethylene based PVC offers, surging CNY500-600/ton ($75-90/ton) from earlier week on the back of bullish sentiment. Supporting factors including supply tightness, high production costs stemming from strict environmental control, healthy demand and strong futures market. For this, many suppliers elected to only focus on local market instead of allocating cargoes for export. An ethylene based PVC maker in Ningbo informed, “We implemented some $40/ton hike on our export offers. We temporary focus on supplying to domestic buyers, as demand here might remain vivid throughout the first half of October.

There is little improvement in the Southeast Asia sentiment, yet offers from international suppliers continue to move higher solely due to limited availability. Many converters in Vietnam, Malaysia and Indonesia are complaining about slow end product demand, hence higher prices did not stimulate strong buying interest. Even regional local markets are witnessing higher offers level. An Indonesian converter purchased domestic produced cargoes at $30/ton higher than last month informed, ““Our suppliers are very firm on their prices and we only received some discount because of the exchange rate. International market is firming up and might provide further support for domestic sellers to increase their offers further in the near term. Our end product business has yet to show any significant improvement, however we do expect better condition toward quarter 4.”

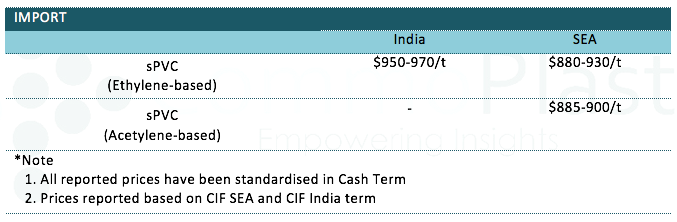

A summary of import PVC prices to the region is shown in the following table: