Asia Weekly PVC Overview (Week 40, 26-30 September 2016)

Asia Weekly PVC Overview (Week 40, 26-30 September 2016)

Market firmer on escalating upstream costs, Chinese buyers prepare for Golden week

In Asia, the sentiment is calmer than the previous trading week due to the fact that buyers have concluded a large part of needed quantity. Meanwhile, Chinese players are entering the National Day holidays, from which trading activities in the country is diminishing towards the end of the week.

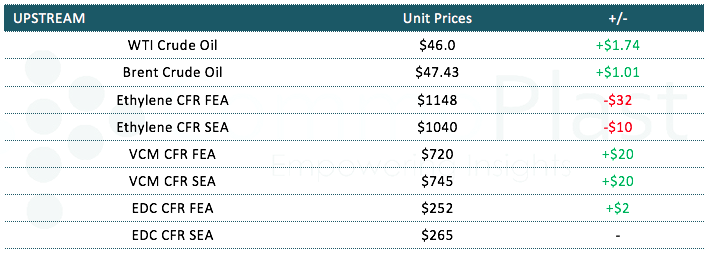

Rising upstream costs on the back of limited VCM supply amid maintenance shutdown season are encouraging sellers to implement additional hike on their cargoes, however, buyers are considering their purchases at higher levels. An Indian buyer received Japanese PVC offers at $970/ton CIF, LC AS term, excluding an antidumping duty of approximate $15/ton, said, “This offer is a little too high at the moment. However, we think that suppliers might hold firm on their prices due to expected better demand in the near term as the monsoon is ending.”

Players here also expected tightening supply from a major Korean supplier due to an on going overhaul. As CommoPlast reported earlier, South Korea’s LG Chem planned 21 days maintenance shutdown at its Yeosu PVC line last week and the plant might only resume operation by third week of October, sources said. “Further price increment in the coming month is very possible, and we are assessing latest development in the market to gauge the range of next hike and market acceptability.”

In China, domestic offers continue to add CNY50-100/ton ($8-15/ton) from last week though players reported seeing fewer numbers of deals affected by the upcoming National Day holidays. Suppliers remained optimistic about the post-holiday outlook despite the humble tone in their expectation for addition hike. An ethylene based PVC producer in Ningbo commented, “Supply condition should improve after the holidays as plants remained running in the absence of buyers. For this, we are looking at mostly stable to slightly firmer trend for post holiday’s term. Our domestic customers have mostly replenished sufficient cargoes by now, hence we think the urge for fresh purchases might be weaker.”

Buyers in Southeast Asian market are very reluctant to accept the recent new offers claiming sufficient inventories and slow end product demand. A buyer in Vietnam informed, “Our end product business is weaker than usual and the latest hike in PVC prices is squeezing our margins. We have already stocked up comfortable inventories to cover production need till early November.”

A Chinese carbide based PVC maker concurred, “We maintained our offers at $890/ton FOB China, LC AS term in spite of $30/ton increased from other suppliers; yet out S. Asian customer responded very poorly.” Therefore, Southeast Asia market might continue trailing behind other neighboring markets in the near term when it comes to demand.

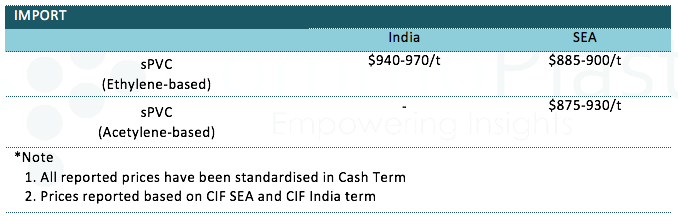

A summary of import PVC prices to the region is shown in the following table: