Asia Weekly PVC Overview (Week 41, 03-07 October 2016)

Asia Weekly PVC Overview (Week 41, 03-07 October 2016)

Discounts observed in S. Asian market, Indian buyers cautious ahead of holidays

In Asia, market sentiment turn calmer this week in the absence on Chinese buyers during the National Day holidays. There is very few number of offers reported as players have mostly concluded October shipment businesses and currently monitoring market movement to gauge the likely market direction for November shipment.

There are no trading activities in China this week and players shall resume working on 10 October 2016.

There is little improvement in term of demand within Southeast Asia market and this condition in face has been persisted for sometimes. Despite the initial $40/ton hike implemented by a major Taiwanese producer and other makers, several regional suppliers have to step back on their hike target this week in order to smoothen sales process. A pipe converter in Malaysia received Thailand PVC offers at $880/ton CIF, LC AS term informed, “Our suppliers cut prices by $20/ton, however, we have sufficient inventories, hence not in rush to make additional purchases. We think prices might near to the peak, as demand is very weak at the moment. However, we might need to monitor the purchasing appetite in China and India further.”

Another buyer reported receiving Indonesian PVC at $10/ton reduction from the previous offer at $875/ton CIF Malaysia, LC AS term commented, “We plan to replenish a small quantity as we think this offer is very competitive.”

Meanwhile, in India, the monsoon might come to an end soon, which probably stimulates buying activities. However, many buyers are taking more cautious stance ahead of the Diwali holidays with a source said, “We are not planning to take position this time as we already stocked up sufficient quantity from previously purchased cargoes. Buyers might postpone their replenishment till after the holidays, therefore we prefer to hold wait and see stance before making major decision.”

On the other hand, a major local producer has up adjusted local offers for PVC by INR2000/ton ($30/ton) compared to last month on the back of firming trend in the international ground and expected improved demand. For this, many players are looking at continuous firming trend in the near term.

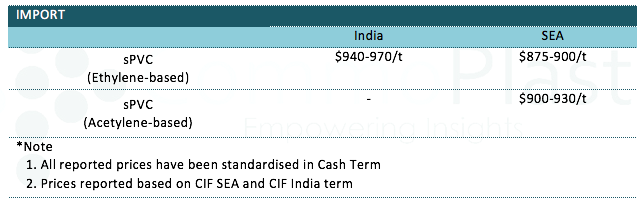

A summary of import PVC prices to the region is shown in the following table: