Asia Weekly PVC Overview (Week 46, 07-11 November 2016)

Asia Weekly PVC Overview (Week 46, 07-11 November 2016)

Prices continue to surge, buyers on the side-line wait for new offers

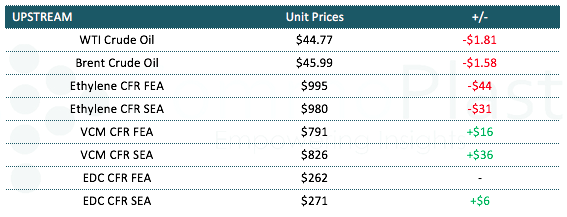

In Asia, PVC market is quiet this week awaiting Taiwanese major to announce December shipment offers. Many have expressed their expectation for $40-60/ton hike from major international makers, in line with the increases in the VCM costs. In fact, VCM prices in Asia have escalated to two-year high this week due to bullish downstream market condition and increased freight costs. However, the general demand condition appears to be not very supportive for such large hike, players said.

In fact, initial expectation is that the start of the peak seasonal demand in India would boost regional sentiment. Things have changed slight this week, when the Indian government decided to demonetise high-value currency notes, creating a temporary liquidity issues in the market and dampens buying interest. A trader added, “Players are not very confident about the upstream and energy market as well, therefore most have turn to source material hand to mouth basis. We are seeing USA cargoes being offered at pretty competitive levels even with the antidumping duties. We think market might be reluctant if December shipment offers increased in large range.”

Meanwhile, in China, local offers for both carbide based and ethylene based PVC cargoes increased another CNY300-400/ton ($44-59/ton) from last week thanks to strong futures market and persistent supply tightness condition. Carbide based PVC makers are holding very firm on their cargoes claiming thin profit margins stemming from high feedstock costs. On average, domestic carbide based PVC offers stand at CNY8100-8250/ton ($1018-1037/ton without VAT), EXW China, cash term. A market source informed, “We heard rumors about government interference to minimize market speculation on coal prices, however, our carbide based PVC suppliers are very steadfast on their cargoes, pointing to strong support from futures trading. We think market would sustain the stable to firm trend in the near term.” The most actively discussed topic in local China market is still transportation issues, which limit the flow of material to Eastern and Southern China area for some time now. However, demand is reported to be slowing down ahead of the winter season. Many pipe converters have reduced operation rate by 40% due to high material costs, in which further price increment might encounter resistance.

Southeast Asian players reported to have received Chinese carbide based PVC at above the $1000/ton threshold, at $1020-1050/ton CIF Malaysian, LC AS term, chasing after other polyolfin offers in the region such as PP. Converters in Malaysia and Indonesia have expressed their unwillingness to accept such high prices given sluggish end product demand. On the other hand, a trader in Vietnam informed, “Demand in local market is healthy at the moment, and we think market still has some room to firm up further in the near term.”

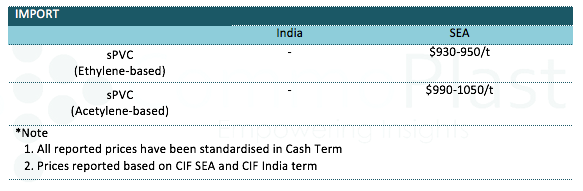

A summary of import PVC prices to the region is shown in the following table: