Asia Weekly PVC Overview (Week 48, 21-25 November 2016)

Asia Weekly PVC Overview (Week 48, 21-25 November 2016)

December shipment announced higher, India market remained sluggish

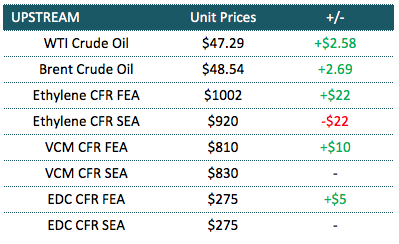

In Asia, major Taiwanese producer implemented further hike on December delivery cargoes, however at smaller range than initially expected for India market. This is the fifth month in a row the maker lifted offers to export market, accumulating up to $200/ton increment compared to July. Despite the weak demand condition in key India market, regional players believed that the current market trend might sustain into 2017.

Since the demonetization take place in India, the market is left with critical cash shortage condition, hurting most businesses. Many traders here are seeing 60 to 70 per cent drop in sales revenue compared to the past months and this condition is not expected to end anytime so soon. Together with the depreciation of the Indian rupee, demand here is just too disappointed for international suppliers. Yet, latest offers from Taiwanese major have surged above the $1000/ton threshold – the highest level since November 2014. A trader said, “There is no purchase enquiries from converters. Most traders take up the cargoes and wait for prices to increase.”

It is interesting that December delivery allocation from Taiwanese major to India reduced by two-third and this quantity is being diverted to China. And it is even more interesting that Chinese buyers can absorb completely the excess allocation within two working days without any major discount. An international trader explained, “China market has been lacking of supply for sometime, hence this is a good opportunity for buyers here to stock up the needed quantity.”

At the meantime, Chinese producers started to down adjust offers for carbide based PVC to local buyers after two months of continuous rally. This come as a surprise to many players considering such smooth transaction reported in the import ground. A carbide-based maker in Xinjiang who dropped their offers by CNY250/ton ($36/ton) compared to last week, reaching CNY7750/ton ($958/ton without VAT) said, “The volatile futures market is pushing our customers to the side-line. Many customers in the construction sector claimed to have stocked up sufficient inventories, therefore buying interest is rather weak.”

Such reduction is expected to bring market back to balance where ethylene base PVC could maintain a premium of about CNY200/ton ($29/ton) over carbide-based material. However, buyers are not looking at the possibility of any significant reduction, yet the upside might be limited.

The Southeast Asian market witnessed little improvement in term of demand in line with the monsoon season and the currencies depreciation hit. Over the past several months, prices in the region are mainly driven by the state of demand in India and China market. A number of converters across Southeast Asia claimed to have sufficient material, and refused to make fresh purchased at multi-years high levels. A pipe converter in Vietnam informed, “We made a large purchase a week ago for USA material at below $900/ton threshold, and we are comfortable with our inventories right now. Domestic supply is not very high, yet buyers are very cautious given the weakening Vietnamese dong against the USD.”

Local PVC prices in Indonesia responded strongly to the latest offers in the import ground, adding another $50/ton compared to last month regardless of the persistent sluggish demand condition from pipe and profile sector.

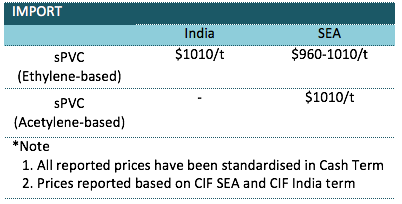

A summary of import PVC prices to the region is shown in the following table: