Asia Weekly PVC Overview (Week 50, 05-09 December 2016)

Asia Weekly PVC Overview (Week 50, 05-09 December 2016)

Traders cut offers, sentiment weakened

In Asia, the general sentiment is weaker this week as China enters the low demand season, which continues pulling domestic prices lower. International traders appear to be loosing confidence in the near term outlook, therefore reducing prices in order to speed up sales amid sluggish buying interest across the region. Besides, the availability of low price USA cargoes is putting even more pressure on the market.

China took over the leading role in term of demand in the past month after India clashes with cash shortage crisis, and support firmer trend across the region. However, buying interest in China started waning, dragging domestic prices down for three weeks in a row now. In fact, local carbide based PVC this week drops another CNY50-100/ton ($7-15/ton) while ethylene based PVC slashed CNY200/ton ($29/ton). Worries not. While a downtrend is inevitable, domestic producers are attempting to avoid a hard landing by agreed to a pricing framework during the PVC Northwest United Body conference on 6 December 2016. The framework called for a floor and ceiling levels, which aims to eliminate heavy speculation that could bring market out of order. A market participant, who attended the conference said, “Producers have not worked out on measures in the event market run out of the pre-set range. Therefore, we think trend would still depend on supply-demand fundamental.”

An ethylene based PVC producer meanwhile is more optimistic saying, “We reduced our offers this week to bring back the normal gap between carbide and ethylene based PVC. Demand is weaker, yet we are looking at more of a stable to soft trend instead of any large reduction.”

In Southeast Asia, converters continue seeing little improvement in end product businesses and the depreciation of local currencies is deterring buyers from making large purchases. Most are seeking for lower price cargoes to minimize the costs. And traders have decided to cut their offers to the region in order to stimulate buying interest. Both Malaysian and Vietnamese buyers reported to have received PVC offers from Fareast Asian suppliers at $935/ton CIF, LC AS term, which is $25-35/ton lower than last week. A Vietnamese converter said, “One of the Taiwanese producers is offering at $935/ton CIF Vietnam, LC AS term; however, we decided to buy USA cargoes at $870/ton with the same term. Market is going down. Our end product business is a little weaker, in addition to the depreciation of the Vietnamese dong, we could not afford to purchase cargoes above the $900/ton threshold.”

A Malaysian trader informed, “Earlier this week, our Chinese supplier was still maintaining ethylene based PVC offers at $970/ton CIF term; however, face stiff resistance. Today, the maker has stepped back on their offers by $35/ton. Such move could be due to falling local demand in China, and this is very risky.”

International suppliers are about to announce January delivery offers, and with weaker China spearhead, it might be more difficult to achieve any price increment even at firm upstream costs.

The situation in India has yet to be alleviated and trading activities remain low. Market might need more time to adjust itself to the current condition before better demand is reported.

In related plant status news, India’s Reliance and Korea’s LG Chem is planning a maintenance shutdown in January 2017.

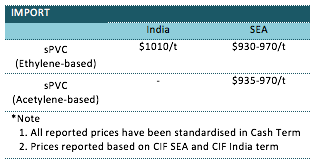

A summary of import PVC prices to the region is shown in the following table: