Asia Weekly PVC Overview (Week 51, 12-16 December 2016)

Asia Weekly PVC Overview (Week 51, 12-16 December 2016)

January offers plunged, buyers are cautious

In Asia, major Taiwanese producer announce January offers with $50/ton reduction to regional market, ending five consecutive moths of price hike. Players are surprised with such large reduction and become more cautious about the outlook in the near term. Other international makers have announced similar price cut.

It its reported that the Taiwanese major has reduced export allocation this month on general weaker demand across the region; however, couple of distributors are raising expectation for a rebound in the coming month. Discussing on this matter, a Vietnamese buyer commented, “We think whether market can rebound, it very much depend on how fast India recover from the current cash crunch. For our side, demand usually slower after Lunar New Year.”

Market sources are also looking at the appreciation of the US dollar as one of the factor hurdle seller’s effort to increase prices. Converters are complaining about the difficulties they face in transfer the costs to end product even at the current PVC prices, and any further increment would hurt their profit margins.

Meanwhile, in Malaysia, import Chinese carbide based PVC slipped below the $900/ton threshold and latest deal concluded is reported at $870/ton CIF Malaysia, LC AS term. This level indicated nearly $100/ton dropped from last month’s average prices for the same material. A converter purchased the cargoes commented, “We are now covered until February and planning to halt additional replenishment. We are hearing about some competitive Chinese ethylene based PVC parcels in the market, however, we are not very interested.”

In China, persistent weak PVC futures on Dalian Commodity Exchange continue to drag spot offers in local market down CNY200-450/ton ($29-65/ton) for carbide based and CNY100-250/ton($14-36/ton) for ethylene based PVC. However, suppliers started to take firmer stance on their cargoes after news about Taiwanese major sold out allocated quantity to the country. An ethylene based PVC producer shows more optimistic expectation saying, “We believed that to avoid transportation issues, local buyers would have to make pre-Lunar New Year replenishment as early as within this month. We are not planning to give steep discount in the near term.”

However, players are counting on Chinese producers’ ability to deplete on hand inventories before the holiday season starts. Failing in doing so could result in further reduction in both local and export market.

In India, market sentiment remains weak and players are expecting this condition to persist in the next two to three months. Cargoes from irregular origins including Russia are flowing into the country at competitive price levels, yet buying interest in very low, players said.

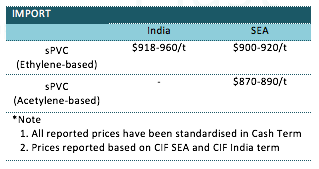

A summary of import PVC prices to the region is shown in the following table: