Asia Weekly PVC Overview (Week 52, 19-23 December 2016)

Asia Weekly PVC Overview (Week 52, 19-23 December 2016)

Southeast Asia sees deeper discount, limited trading activities ahead of holidays

In Asia, market sentiment is weakening ahead of the long Christmas and New Year holidays. Players are refraining from making large purchases claiming slow end product business and anticipated bearish outlook in the coming month. Southeast Asian buyers are receiving additional discounts from the initial January offers that already showed larger than expected reduction. With the latest price cut this week, the total drop in offers from last month is very near to $100/ton.

In fact, Vietnamese buyers reported to have received another $30-40/ton discount on Taiwanese PVC this week, dropping below the $900/ton threshold for the first time in months, reaching $880-890/ton CIF Vietnam, LC AS term. A converter informed, “Most other suppliers have also down adjusted their offers due to persistent weak demand here. We think the down trend is not nearing the bottom as traders are very aggressive in depleting their cargoes.” The sources also reported to have received offers for USA PVC at $860/ton and Chinese carbide based PVC at $850/ton with the same shipment and payment term.

Malaysia is not excluded from such movement with carbide based PVC concluded below $850/ton threshold this week. The latest price conclusion indicated approximate $100/ton reduction from last month for the same material. A converter purchased the cargoes at $845/ton CIF Malaysia informed, “We did not receive any other offers lower than this level, therefore we decided to make a small replenishment. Outlook for the coming month is rather cloudy, yet we believed that with India market remain quite, it is less likely that price could firm up significantly.”

Rapid price deterioration in Southeast Asia is sending a chill wave across the region and many decided to withdraw to the sideline to monitor further market development after the holidays. There is almost no improvement in term of demand in India, and interestingly, even with such buying condition, offers to the country are just not dropping as fast as it is in Southeast Asia. A trader commented, “Our Taiwanese supplier’s final price to India stand at $960/ton CIF term and we did not receive any additional discount. It is surprised to see the latest development in Southeast Asia market. For India, we only can hope to see better demand in the coming month.”

It appears that pre-Lunar New Year replenishment activities in China is not happening, causing massive reduction in domestic prices, especially on carbide based cargoes. In fact, carbide based PVC offers fell CNY300-500/ton ($43-72/ton) week on week while ethylene based PVC drop CNY350/ton ($50/ton). An producer commented, “Demand is very weak and we plan to keep our offers stable in the coming week. It just look difficult to hold firm on our cargoes now as traders are very aggressive in giving discount, putting tremendous pressure on the market. Besides, weakening futures market is wiping away buyer’s confidence.”

In another news, Japanese conglomerate - AGC Asahi Glass in an official statement announced that the company has successfully purchased the 58.77 per cent of Solvay’s shares in Thailand PVC maker – Vinylthai. The transfer of the shares is expected to complete in the first half of 2017. With this acquisition, AGC has established a very strong presence in key Southeast Asian markets: Indonesia, Thailand and Vietnam.

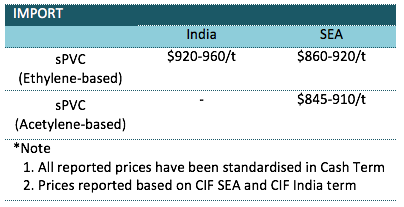

A summary of import PVC prices to the region is shown in the following table: