Asia Weekly PVC Overview (Week 01, 03-06 January 2017)

Asia Weekly PVC Overview (Week 01, 03-06 January 2017)

Southeast Asia remain weak, fresh offers expected to be stable

In Asia, market remains on the soft note this week with fewer offers as players are waiting for February prices from major international producers. Purchasing activities across the region has yet to see any significant pick up, which forced traders to implement further price cut in order to deplete inventory. However, there are reports about better buying interest from Indian and Bangladesh customers, which foster expectation that prices might be nearing the bottom.

An ethylene based PVC producer in China reported, “Instead of dead silence like in the past couple of months, several of our Indian and Bangladesh buyers are requesting for offers. Market outlook seems to have better prospect now.” Several Taiwanese traders are reporting similar situation.

Actual demand in India however remains much weaker than it should be at this time of the year, yet players here are rather optimistic about the outlook. A trader commented, “Purchasing activities might pick up in February after the government announce 2017 budget.”

Meanwhile, offers to Southeast Asia, especially for Chinese origin material continue to move lower throughout the week, and buyers are very active in negotiating for further discount before concluding deals. A Malaysian pipe maker bought Chinese carbide based PVC at $800/ton CIF, LC AS term commented, “We think this level is rather competitive and we decided to take additional quantity despite having comfortable stock on hand. Market might be nearing the bottom considered the current energy values and a potential come back in India.”

In China, falling futures prices has dampened buying interest for spot cargoes while it seems buyers are still not eager for pre-Lunar New Year replenishment. On the other hand, the recent government’s effort to combat air pollution has forced companies to cut operation rate and restrain road transportation. If this condition persists in the near term, the flow of material from the north to other areas in the country might again be affected. A carbide based PVC producer in Inner Mongolia said, “Our production costs are high and marching the current market condition might really hurt our profit margins. We decided to suspend all offering, waiting for international makers to announced February shipment prices before setting our offers.”

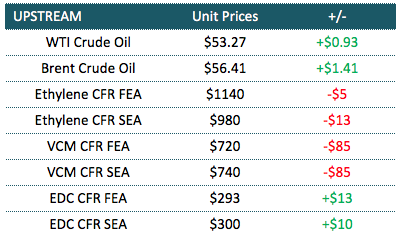

Major Taiwanese producer is expected to announce fresh offers in the coming week and initial market expectation is that the maker might rollover January prices. The strongest justification for such anticipation is lay in the preliminary sign of pick up in demand from Indian continent buyers. Players are also adding that low priced USA cargoes might gradually fade from the market as USA producers pay more attention to local ground after the holiday season. The only factor that might downplay suppliers’ effort to stabilize the market trend is the large reduction in VCM costs.

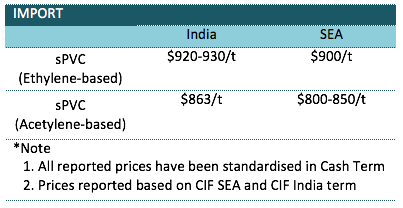

A summary of import PVC prices to the region is shown in the following table: