Asia Weekly PVC Overview (Week 02, 09-13 January 2017)

Asia Weekly PVC Overview (Week 02, 09-13 January 2017)

February offers stable to firmer, buying interest revived in India

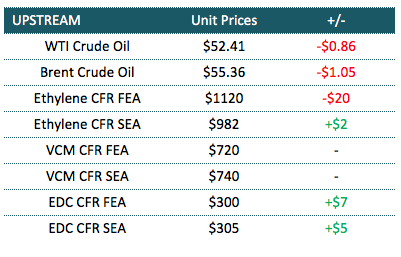

In Asia, major Taiwanese producer announce February shipment offers at unchanged level for Southeast Asia and China customers while lifting prices to India by $10/ton compared to last month. Buying interest in India started to come back and players expected that the rebound trend might sustain in the coming month considering the reduced availability of USA cargoes and high production costs for carbide based PVC maker.

As Taiwanese major closed offers on Thursday, players informed that Indian buyers received about 75 per cent of regular allocation this month. Buyers here have generally accepted the hike due to lack of availability in both market and the supply pipeline. A trader commented, “Demand in northern India is good, however the general condition might be moderated by mediocre buying interest in the West Coast area. We continue to hope for better purchasing appetite in the near term.”

Meanwhile, purchasing activities in China has also picked up visibly partially due to pre-Lunar New Year replenishment, in addition to the support of firming international ground and strong futures trading. Domestic offers jumped CNY100-300/ton ($14-43/ton) week on week basis with a trader commented, “We are firm on our cargoes and managed to conclude a good quantity. However, market might slow down in the coming week as converters are gradually cutting operating rate to go off for holidays.”

Export offers from China are reported to increase $20/ton week on week basis and producers, especially carbide based PVC makers are showing less willingness for price negotiation now. A producer informed, “We are bearing higher production costs stemming from strict environmental control. We have temporary suspended all export offers to monitor further development before announce new prices. At the moment, it does look like market is moving north.”

In Southeast Asia, prices below the $800/ton threshold are no longer available this week while buyers are seeing less of USA cargoes in the market. USA’s PVC firmed up $30/ton from last month to reach $890/ton CIF Vietnam, LC AS term with a converter commented, “Our suppliers are paying more attention to local USA market while demand in Europe is also picking up after the New Year holidays. Therefore, our suppliers are not giving mass offer this time.”

In related plant status news, Philippine Resins Industries Inc. is planning to double up its PVC output by early 2019 by investing approximate $608 million on the expansion project, which expected to kickoff in February 2017. Upon completion, the new facilities are expected to add 110,000 tons/year to the current output, lifting total production capacity to 210,000 tons/year.

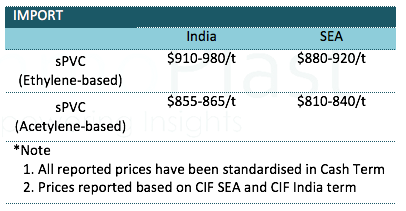

A summary of import PVC prices to the region is shown in the following table: