Asia Weekly PVC Overview (Week 03, 16-20 January 2017)

Asia Weekly PVC Overview (Week 03, 16-20 January 2017)

More suppliers lifted offers, buying interest softened in China ahead of holidays

In Asia, more international PVC producers announced new offers with increases after Taiwanese major pioneered the trend in the previous week. However, it appears that buying interest in China and Southeast Asia is fading as many buyers here claimed to have replenished sufficient material and now departing for the long Lunar New Year holidays. On the other hand, traders hold very positive expectation for the demand prospect in India in the near term.

It is reported that more Korean makers announced fresh offers this week with increases, especially to India; however, buyers here are considering the purchases in the presence of more competitive Iranian cargoes. A trader received Iranian PVC offers at $910-920/ton CIF India, LC AS term commented, “This cargo is about $60-70/ton lower than offers given by our Korean suppliers, which is relatively attractive at the moment. We are still unsure about the sustainability of the current demand condition, yet we do hope the cash crisis to end soon.”

Meanwhile, trading activities are limited in the absence of buyers though suppliers refused to concede large discount on their prices pointing to firm upstream costs and strong support from futures trading. Local offers for both ethylene and carbide based PVC softened CNY100-200/ton ($15-29/ton) week on week basis with a trader informed, “We managed to conclude some deals at the beginning of the week and sentiment just slipped toward the week-end. It is very difficult to arrange delivery at the moment, therefore many parcels we can only delivery after the Lunar New Year.”

An ethylene based PVC producer in Ningbo informed of plan to bring their plant off-stream in March for maintenance, yet, no confirmed date and duration of the overall at the moment.

Export offers from the country remain mostly stable from last week with several carbide based PVC prices reported below the $850/ton threshold, based on FOB China term. Many have also expressed positive expectation for domestic market outlook in the post holiday period.

Buying appetite in Southeast Asia shared similar condition as it is in China as buyers claimed to have made sufficient purchases before the price hike. A Malaysian pipe maker received Chinese carbide based PVC at $830/ton CIF, LC AS term said, “We have stocked up inventories for the next few months and not in rush to made fresh replenishment at the moment. However, we think it is very less likely that prices would go down.”

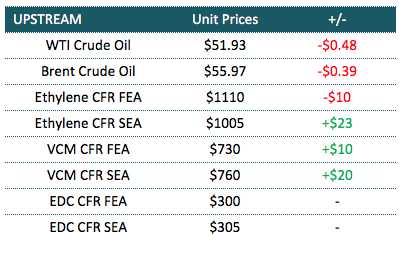

In fact, VCM costs in Asia is likely to firm up in the near term as supply across the region tightened on the back of maintenance shutdown season. As reported earlier, Japan’s Tosoh Corporation is planning annual turnaround at two of its VCM lines during the first half of the year, starting in March while Indonesia’s Asahimas scheduled shutdown at its no.1 and no. 3 VCM lines in February and April respectively. Details of these shutdowns can be found on CommoPlast Plant Status section.

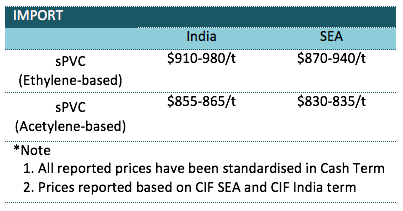

A summary of import PVC prices to the region is shown in the following table: