Asia Weekly PVC Overview (Week 06, 06-10 January 2017)

Asia Weekly PVC Overview (Week 06, 06-10 January 2017)

New offer expected with hike, demand in India continue to improve

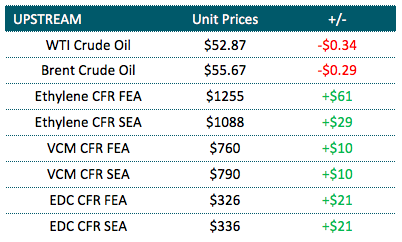

In Asia, there are very limited number of new offers observed in the market and players are expecting fresh prices from major Taiwanese maker in the coming week. Given strong upstream costs and improving demand condition in India, March delivery offers are set to move higher, regional players indicated.

In discussion with a number of market participants in India, it is reported that demand here is recovering from nearly three months of depression due to the cash crisis stemming from the demonetization. Despite the impending Thaipusam holiday on 9 February, Indian players appear to be very active in the market, pointing to the bullish outlook and low availability. For this, market is anticipating new offers from major Taiwanese maker for March shipment to hike $30-40/ton from last month, breaching above the $1000/ton threshold. A trader in the country commented, “We are not seeing many factors deterring buyers from accepting the new price levels as the monetary issues are receding now. Demand is improving and would continue to advance this track in the coming month.”

In China, there are still very limited numbers of transaction observed in the market as most buyers here would only resume operation after the Chap Goh Mei celebration on the 11 February. However, domestic offers firmed up CNY50-100/ton ($7-15/ton) compared to last week with the support from strong futures market. Players reported that supply within China might remain tight in the near term as strict environmental control constrains operation rate at many carbide feedstock plants, causing lower run rate at downstream carbide based PVC production.

Export offers from the country has also firmed up, and carbide based PVC priced below the $850/ton is very scared at the moment. A carbide based PVC maker offered at $860/ton FOB China, LC AS term informed, “Export prices are moving toward the $900/ton direction with the support from improving demand in India market and tight allocation from Japanese makers due to maintenance shut down season. We are very optimistic about the near term outlook.”

Meanwhile, in Southeast Asia, a good number of converters claimed to have stocked up sufficient material for the next couple of months in anticipation of continuous price increment in the next offer announcements. A pipe and profile maker in Malaysian said, “We have comfortable material till June. We decided to build up inventories since India market is coming back and as long as demand in India hold strong, prices would be firm. Especially with the current upstream costs.”

A Vietnamese converter added, “We were not able to replenish too high inventories due to slow end product business. Besides, local supply is also tight due to production issues at one of the local plants. This month we plan to purchase some quantity.”

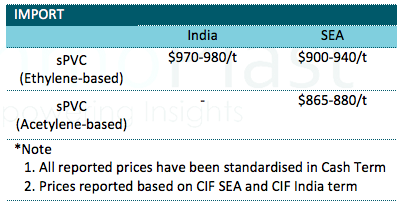

A summary of import PVC prices to the region is shown in the following table: