Asia Weekly PVC Overview (Week 11, dated 13 - 17 Mar 2017)

Asia Weekly PVC Overview (Week 11, dated 13 - 17 Mar 2017)

Softened upstream pressure sentiment, new price announcement postponed

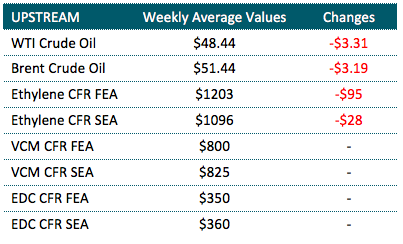

In Asia, there is little movement reported across the region this week as players are waiting on the side-line for international suppliers to announce April offers. Major Taiwanese maker is expected to open fresh prices at the beginning of next week with increment. However, sentiment is dampened by continuous falling energy and ethylene market, which might cause buyers to reconsider their purchases.

Explained to the later than usual new price announcement, An Indian buyer reported, “Most Indian companies in all sizes are rushing with year end book closing and settling annual tax before 15 March. Therefore, new price announcement this week might attract less than expected attention. We were informed that new offers would be opened on 20 March, and hike is very likely.”

However, it also appears that Indian buyers are loosing confident in the near term market outlook as a result of continuous falling energy and ethylene market. Initial expectation called for $40/ton month on month increase with another trader commented, “New offers would reach multi year high level, and despite tight availability in local ground, we become unsure about buyer acceptance at the current upstream situation.”

In China, improving futures trading has encouraged domestic suppliers to take firmer stance toward their cargoes with only carbide based PVC offers softened CNY100/ton ($14/ton) while ethylene based PVC remain mostly unchanged from last week. There is little improvement observed in term of demand in China despite the China's National People's Congress has ended, allowing a number of converters in Northern area to resume regular operating rate. “However, many others are still offline due to the waste management issues. Domestic inventories remain high this week, though we plan to lift our offers if overseas supplier implement hike for the new month,” an ethylene based PVC producer commented.

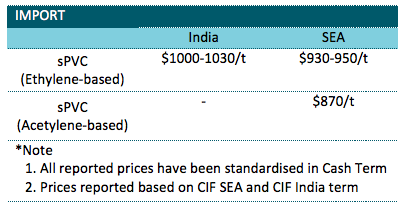

In Southeast Asia, players still reported the availability of Chinese carbide based PVC at $870/ton CIF, LC AS term. This might be the pressure point toward other international suppliers, preventing full hike achievement. A Vietnamese buyer brought up the concern over the competitive Chinese carbide based cargoes and also falling upstream costs added, “Our Japanese suppliers in contrast, do not seem to have any intention to maintain or lower prices for April shipment. We were informed that new offers would be higher given lack of availability due to maintenance shutdown.”

Domestic suppliers in Indonesia have also implemented $30/ton hike on their cargoes reaching $1040-1070/ton FD Indonesia, cash term. A PVC sheet manufacturer purchased the cargoes at $1070/ton FD Indonesia said, “Our supplier is very firm on their prices citing healthy demand in the export ground. With market outlook hold bullish in the near term, we think it is very likely that suppliers would firm up offers again in the coming month.”

A summary of import PVC prices to the region is shown in the following table: