Asia Weekly PVC Overview (Week 13, dated 27 - 31 Mar 2017)

Asia Weekly PVC Overview (Week 13, dated 27 - 31 Mar 2017)

Regional demand remains weak; falling upstream costs added extra pressure

In Asia, buying interest across the region remains relatively weaker than expected at this time of the year. There are rumors that major Taiwanese producer has yet to conclude April business, from which several other international suppliers decided to step back on their offers in larger range. However, sellers are also hoping that the shutdown at a number of plants could provide some support to the market in the near term.

In India, buyers reported receiving Korean PVC offers at $1000/ton CIF India, LC 90 days term. The source added, “Buying interest in still weak. This is very surprising to us as demand normally pick up at this time of the year. We think besides the financial issues, lack of spending from government has also affected end product businesses.” Even with the reduction for the main stream cargoes, buyers claimed to have received offers for Iranian PVC at $950-06/ton CIF India term with a buyer added, “Market is not highly preferred this parcel, yet it plays an important role in putting extra pressure on other international suppliers. We are not very optimistic about the near term outlook.”

In Southeast Asia, import carbide based PVC from China continue to move lower with Malaysian converters reported to have concluded deals for the cargoes at $825/ton CIF Malaysia, LC AS term, some $20/ton drop week on week basis. A converter purchased the cargoes informed, “We concern that the weakening trend might persist in the coming weeks, therefore we only procured a small quantity this time. Meanwhile, we are monitoring the development in India market to gauge the likely market direction in the near term.”

Vietnamese buyers also see additional discount for Chinese ethylene based PVC this week at $880/ton CIF term. A local trader commented, “Domestic demand might weaken in the coming month due to monsoon season, therefore we are planning to slow down on replenishment activities. Market outlook is not very optimistic in Southeast Asia even with couple of shutdowns. We prefer to adopt conservative stance.”

In domestic China market, the on going environmental compliance inspection continue to affect downstream demand, coupled with the volatile futures market, local suppliers again reduced offers for ethylene based PVC by CNY100-150/ton ($14-22/ton) to attract buying interest. “Many pipe manufacturers are still operating at low rate while some others are seeing improvement in end product orders. We hope the purchasing activities could continue to pick up in the coming month. At the moment, buyers are not aggressive given the upcoming Tomb Sweeping Festival holidays.”

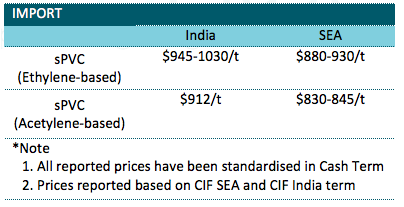

A summary of import PVC prices to the region is shown in the following table: