Asia Weekly PET Overview (Week 13, dated 27 - 31 March 2017)

Asia Weekly PET Overview (Week 13, dated 27 - 31 March 2017)

Market remain on stable to soft trend, weak upstream costs dampens sentiment

In Asia, there is little improvement in term of demand across the region as buyers mostly adopted wait and see stance hoping that continued falling upstream costs could bring more discounts in the near term. Chinese suppliers therefore, reportedly cutting export offers by another $10-20/ton decreased from last week to encourage purchases while others are keeping offers unchanged, expecting the start of high demand season could boost replenishment activities.

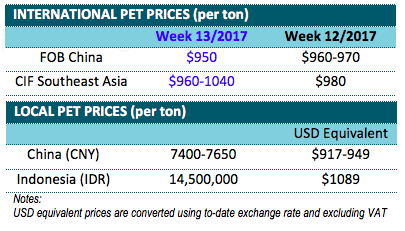

In fact, export offers from couple of Chinese producers dropped to $950/ton FOB China, LC AS term this week. A producer added, “We are very disappointed with the current state of demand. Even in local China market, buying interest in not very strong at the moment. Many converters prefer to take wait and see stance given the Tomb Sweeping Festival ahead. We therefore, are not very optimistic about the near term market outlook.”

Persistent slow restocking activities in local ground are also blamed for the piling inventory pressure among suppliers. Traders are offering CNY100/ton ($14/ton) discount on deal, yet the number of deals concluded is not very satisfactory. Another supplier commented, “We were initially hoping that a series of PTA and MEG plants shutdown would push upstream costs higher, yet it does not seem to be happening. Our customers in Indonesia are preparing to enter the Ramadan season and we hope this would ignite buying interest in this country in the coming days.”

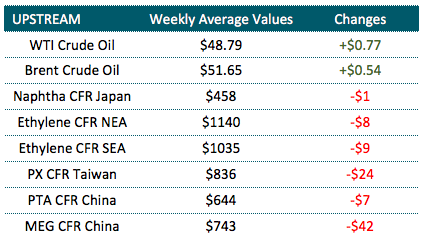

The MEG and PTA costs based on CFR China term have spent most of March on the downtrend, slashing $75/ton and $43/ton in value since the month starts. Industry participants expected this softening trend to persist in the coming week amid weak upstream paraxylene (PX) market.

In Southeast Asia, Indonesian converters reported a slow pick up in demand from bottled mineral water sector. “Ramadan orders are coming in slower than expected. We hope April would be a better month,” a manufacturer commented. However, local producers are taking firmer stance on their cargoes, given the lack of pressure. Indeed, domestic offers remain unchanged at IDR14,500,000/ton ($1088/ton) without VAT, delivered term.

Vietnamese buyers on the other hand reported to have received stable offers from Korean and Thailand producers at the range $1020-1040/ton CIF term. However, it appears that buying interest in this market is not very strong with a buyer said, “The monsoon season is just around the corner, hence we are very cautious with our purchases. With the current upstream costs, we believed that further discount is possible.”

The first half of the coming week might see limited trading activities in China as players in this market are away for the Tomb Sweeping Festival. Asian buyers are monitoring the state of demand in China after the holidays to gauge the likely market direction in April.